Loyalty Tech: Migrate to Microservices, or Get Left Behind

Loyalty systems were some of the first marketing technology, dating back 35 years.

Now, these legacy systems are showing the strain.

Enterprises everywhere are migrating to microservices in order to reduce costs, increase agility and to achieve more with their data.

Making the same progress in loyalty has been much more difficult.

The typical incumbent loyalty technology platform comprises five core modules:

- CRM/Analytics Platform

- Campaign Management

- Points Bank

- Loyalty Rules Engine

- Redemption Catalog

TechCrunch reports that brands such as Airbnb, Disney, and Twitter have seen a 75% reduction in development lead times by migrating to microservices[i].

Customer-side, the greater control and flexibility around data, enabled by microservices, is experienced as more rapid deployment of features, accurate personalization, greater relevancy, and an improved perception of the brand.

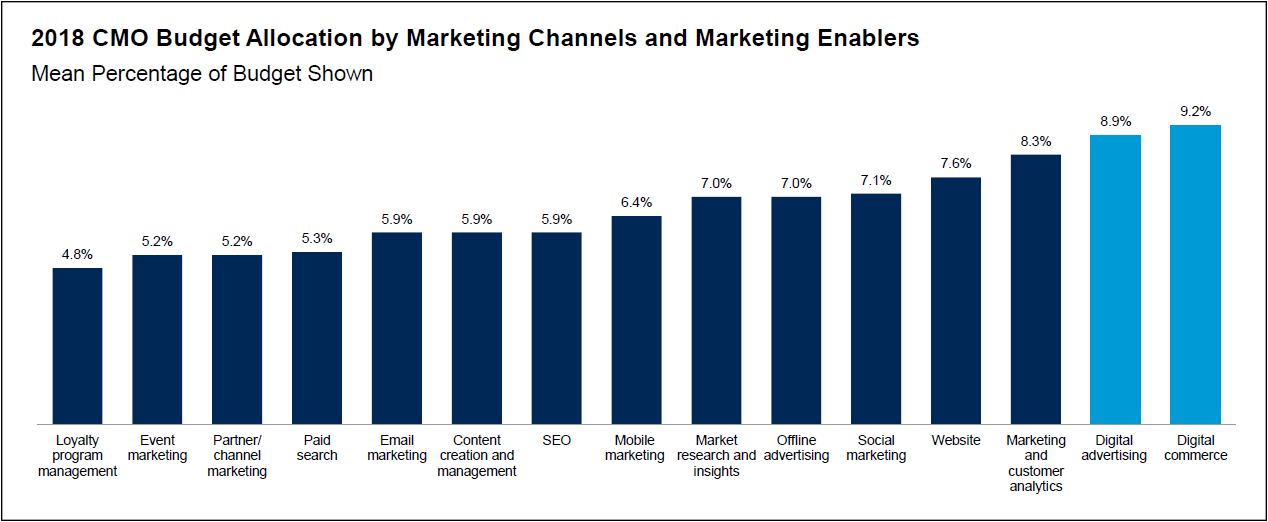

The sea-change in marketing technology is evident in the Gartner CMO survey, which tracked spending across all marketing disciplines:

…most of which are rooted in martech solutions, younger than loyalty program management technologies, but all united by the common need to share customer data and use it to drive results.

Change has been easier in these new categories because most were always designed to be modular by nature.

Change in the legacy loyalty platform, on the other hand, has been difficult and expensive, because the vendor must be supportive, if not fully engaged for nearly any desired change to functionality.

We estimate that almost 30% of the total cost of a loyalty program goes to cover the cost of maintaining and enhancing these systems – value that cannot be passed on to customers.

To an extent, these old systems continue to work, making it hard to build a business case to replace them.

As a result, vendors such as Oracle, Comarch, Kobie, Epsilon, Unisys, and perhaps another dozen have been able to maintain their installed base among the largest loyalty programs, while another hundred vendors provide stand-alone solutions to medium and smaller companies.

But break up those monolithic platforms, we must.

Decathlon athletes must be very good at 10 sports and excel at 3-4 to win competitions – but in any one sport, they are rarely the fastest, strongest, or most agile. This analogy must also be true of software companies that deliver loyalty program management systems.

How can we imagine that a company that offers all five loyalty modules, tightly bundled together, to be the best at every one of the five modules? It seems doubtful.

Fortunately, modular microservices now exist for loyalty – so the remainder of this article lays out alternatives to help loyalty marketers maximize opportunities in what will likely be a hybrid environment for many years to come.

Failing to act will have long-term consequences.

As future technologies such Artificial Intelligence (AI) make inroads into loyalty, you will only ever be able to take advantage of them as quickly as the supplier, or your internal IT department can respond – and this is unlikely to be quickly.

Furthermore, if your own brand doesn’t take advantage of microservices, others will – increasing their competitiveness.

More agile, affordable, and powerful loyalty platforms are now top priority for brands as they seek to build the richest customer insight, and enable differentiation in an increasingly crowded loyalty landscape – where gaining customer attention will be a major bottleneck. Insight into your customers can be made possible by reacting to things that are happening at that moment so you are able to make the necessary changes to help your business grow.

This will render your bundled platform an anchor, unless you add a layer of cloud-based, flexible technology to enable greater collaboration in broader ecosystems.

Today, no brand need submit themselves this risk.

CRM/Analytics

Definition: a database for collecting data about customers with analytics functionality, and the ability to predict future behaviors.

In legacy loyalty systems, the CRM would traditionally be integrated as part of the loyalty stack.

This is now at odds with a current, universal marketing priority, which is to get all customer data into a single enterprise CRM platform, and to cultivate a single source of truth about all customers – which all other microservices can integrate with.

The legacy vendor may not even permit you to get data out of the loyalty platform and into your primary CRM, or vice versa.

I recently had dinner with the Strategic Partnerships Manager for one of the 10 largest airlines in the world and he confessed that they have customer data in three separate systems that each generate customer communications, but do not share data with each other.

Not only does this lead to conflicting messages being sent to the same customer at roughly the same time, but it also means the analytics module is only ever working off an incomplete subset of data.

This makes it difficult to coordinate meaningful touchpoints across marketing channels; and, nearly impossible to consistently reinforce the loyalty strategy.

But when your other four loyalty modules are microservices, rather than bundled, you are free to use whichever enterprise CRM makes the most sense for your organisation.

Some of the CRM platforms optimized for loyalty marketing include…

…Hatch loyalty. This SaaS loyalty solution has a particular focus on building rich customer profiles, and is pitched as a “simple, adaptable, nice-to-use technology platform designed to help you build stronger relationships with your customers.” Hatch has particular experience in the fuel and convenience-store sector.

For bigger budgets, Salesforce is worth a look, simply because their modular ecosystem enables virtually any envisioned capability. Of course, Microsoft, Oracle, and SAP also have solid CRM platforms if your budget permits.

These enterprise and mature CRM platforms are more functional, and suit companies with more complex marketing intelligence needs, beyond just supporting their loyalty program.

However, there are hundreds of CRM platforms in the market and building one from scratch is also not that difficult (if you have access to talented Python developers) – or, if your business requirements are unique in some way and you are willing to invest in maintaining it over time.

A little Google searching, or looking at the Gartner Magic Quadrant for those vendors who pay Gartner to be on the list, will reveal others.

At Currency Alliance, we rarely get involved in defining the enterprise CRM because our clients have long ago selected one, and we simply inject all the relevant data into the enterprise platform.

The point is, enterprises need to get all their customer data into one CRM if they want their analytics and personalization functionality to work as well as possible.

If that CRM is independent of your other loyalty modules, that will unlock much greater agility in setting up and driving omnichannel campaigns.

Campaign Management Platforms

Definition: a tool for managing marketing campaigns and generating messages for delivery through whichever distribution channel is most appropriate for each customer.

Loyalty is earned by the customer’s cumulative experiences with a brand, across all its touchpoints.

This makes convergence on a single CRM platform and single Campaign Management system of paramount importance to maximize coordination of tone, timing, and content that gets sent to customers.

Otherwise, if your company has multiple systems all sending messages, how do you control the degree of marketing pressure you are exerting on each customer?

If two (or four, or five) different systems determine that today is a good day to send an offer, there is a certain degree of probability that the customer does not want two (or four) messages from you today – making you look bad, or encouraging them to unsubscribe.

Brooks Brothers wins the prize for worst marketing pressure management – probably because they have numerous systems running in parallel.

Just about every year, I purchase shirts from Brooks Brothers in-store in the USA; and it appears they automatically subscribe you to every campaign they run. In August and September, every year for the last three years, I have received at least 40 promotional offers before unsubscribing. I had just bought six shirts and didn t need a dozen more. Furthermore, I live in Spain and most of their offers were only valid in the USA – where I can t easily shop in-store, or the shipping cost would erase the value they were offering.

Their system(s) also seem to have no memory of my nearly 30-year relationship with the brand, so each year they bombard me with everything to see what will stick.

Unfortunately, brands are often forced to send out messages from between two and five different legacy systems, based on partial sets of data, stored across multiple databases.

That makes it difficult to prevent any single customer getting bombarded by messaging from different sources, which causes disengagement and unsubscribes. And, it makes it difficult to measure the customer s engagement if they respond in any way.

It is also restrictive from a campaigning standpoint: making it harder to take advantage of your whole marketing inventory for loyalty purposes, or to compare how different segments are reacting to different marketing efforts across different channels.

In fact, if you are A/B testing campaigns, the sending of messages from multiple platforms almost certainly has a correlating effect on customer response actions.

Responsys, a cloud-based Campaign Management platform particularly prevalent in the airline industry, has been adopted by the Landmark Group of consumer brands to avoid this problem.

The Group – which already operates a proprietary coalition called Shukran and owns brands such as Spar supermarkets, Kurt Geiger shoes and Fitness First gyms – has set its sights on loyalty strategies “that address a customer’s entire lifecycle, from acquisition to onboarding, rewards, retention and repurchasing.”

Responsys can be used to “plan and set up automated campaigns, conduct more comprehensive A/B testing, plus produce all sorts of reporting, analysis and optimization which can be shared with different business units”.

Salesforce Marketing Cloud, (formerly ExactTarget), Hubspot and (at a more basic level) Mailchimp can all do similar things: build campaigns, interact at different stages of the customer journey, and schedule triggers and messaging across channels

The more sophisticated platforms enable dynamic communications in response to customer activity, inventory and other triggers identified across any microservice in your enterprise architecture.

Mautic is an open-source community that has developed a fairly comprehensive marketing Campaign Management capability. It can be triggered via APIs and injecting data into their customer profiling platform, but potential buyers should be cautioned that, for their Campaign Management functions to work, most of the customer data needs to be replicated into their data structures.

Whichever campaign management platform you choose, they are all united by a crucial common benefit: data moving easily between platforms, thanks to simple API integration.

Points Bank

Definition: where you keep all transactions involving the loyalty currency issued/redeemed.

At its most fundamental, the Points Bank records earning and redemption transactions – so it’s more likely to be required if you have a points/miles based rewards program.

But even if you don’t offer reward points, you can still assign scores to different touchpoints and behaviors, and use the Points Bank to measure levels of engagement across your marketing ecosystem.

Many organizations have attempted to build Points Banks from scratch.

One is US pharmacy chain Walgreens, which appears to have successfully built a microservice Points Bank which other brands can connect to via an API. They claim that integrated third-party apps have reached “hundreds of thousands of users and distributed billions of rewards points.”

However, most brands’ forays into proprietary Points Banks have not been successful.

Operating a Points Bank is simple if you only issue your own currency. But the moment you sell your currency to partners or issue other currencies, the Points Bank becomes unexpectedly complicated. This is because of the various costs of the points, and various prices at which a single point currency is sold to partners, used in accrual activities, or applied to products and services in the Redemption Catalog.

When organizations realize that they need to manage all these concerns, integrate all the collection mechanics, set rules for when points expire, etc., they either default back to a monolithic legacy vendor, join a single-currency coalition, or live with functional limitations.

Currency Alliance has refactored out a points bank system three times to deal with such complexities, and we would not wish this pain on any brand.

A few vendors have launched a blockchain-based Points Bank – but in most cases they force you to embrace their loyalty token currency.

LoyalCoin wants to “enable loyalty rewards members to convert their reward points into the Loyal Coin digital currency, which they can use to redeem for rewards across different merchants anytime, anywhere.”

Of course that means that customers could earn at one grocery store and redeem at a direct competitor.

Furthermore, it is unlikely that medium or large organizations will embrace a loyalty token because of regulatory issues, or the loss of control over marketplace value. SMEs may find the LoyalCoin proposition more interesting, but until such tokens reaches critical mass (which none yet have), there is a very limited market for customers to earn or redeem.

GlobalMiles‘ blockchain offering presents a similar problem if their currency is embraced, but their collection mechanic – the ability to integrate their platform into POS devices so retailers can easily identify the customer and issue loyalty points without an ugly integration effort – is laudable.

American Express launched a proof of concept using blockchain, supported by the Hyperledger project, which we admire. It appears to take advantage of blockchain characteristics that are desirable while avoiding the pitfalls of too much customer data transparency.

For brands which require a dedicated Points Bank as a microservice, Currency Alliance can help. Our platform can be used either as your brand’s sole Points Bank, or as an extension of your main Points Bank.

The biggest problem for established loyalty programs has been the integration cost (and significant investment in time) of adding partners – if they must be integrated into the primary Points Bank. The Currency Alliance platform can be used to decouple those partners, and their related transactions, making integrations quick and low cost, while all transactions are still processed in real time in the primary Points Bank – so the loyalty program operator has total control and visibility over every transaction with every customer.

For example: British Airways, Iberia, Aer Lingus and Vueling all issue Avios, and the vast majority of those transactions are recorded in their proprietary Points Bank. However, a partner can access Avios and issue them to common customers through the Currency Alliance platform – which captures incremental transactions via an API and then injects those transactions into the primary Avios Points Bank.

The advantage of this is that Avios Group does not need to integrate with every new potential earn or burn partner. Rather, those complementary brands can access Avios via the Currency Alliance API.

The Currency Alliance platform is also agnostic as to where the underlying transactions are stored. They could be recorded in a legacy system, in the Currency Alliance environment, or on various blockchains.

This abstraction, of the application and management layer from the transaction storage layer, gives brands considerable flexibility as we move into a future in which brands collaborate independently of their underlying infrastructure.

Loyalty transactions should end up in one primary points bank, but allowing them to get there via multiple communications paths is liberating for a loyalty program because many historical constraints simply disappear – opening many new customer engagement and partner collaboration opportunities.

Whatever Points Bank (or hybrid environment) you choose to operate, you will derive significant advantages from choosing those that operate as a microservice, because such decoupling greatly increases flexibility in adapting the rest of the architecture to evolving business requirements.

It also gives you the flexibility to embrace additional loyalty currencies that your customers may desire.

Loyalty Rules Engine

Definition: the application-layer logic that determines how many points a customer will earn for purchases and non-purchase activities.

There are hundreds of types of Rules Engines used in business to automate processes.

In loyalty systems, the Rules Engine is a standardized module that accepts variables as inputs, completes one or more computations and determines how many points a customer should get based on their purchase or activity.

For example, a hotel chain could define a rule that granted 2% of a customer’s total spend in the form of points. They could go further and state that Gold members should get 3% and any stays on a Sunday received an extra 1% bonus.

Brands need the flexibility to adjust these rules on the fly, but this is complicated when the Rules Engine is tightly bundled with other platforms.

The loyalty rules can also be programed in the customer-facing platforms – such as apps, websites, point-of-sale devices, or even smartwatches, but that means every time a change to the rules is desired, all these distributed systems need to get updated software.

It is becoming more common that the loyalty rules are now managed in the backend, or on the server side.

This means that, when new insight emerges in customer-facing platforms, rules can be modified or added, and points issuance can be varied, without any changes to the software provided to customers.

The loyalty team simply needs to change the input variables to drive the desired customer behavior.

A brand might also want to work with multiple Rules Engines – possibly provided by different vendors or even a mix with some developed in-house.

Some brands might have a Rules Engine developed many years ago that is used for transactions coming directly from their points of sale. These brands may wish to incorporate new channels, such as mobile apps or partner platforms, or to encourage non-purchase activities. Currency Alliance’s Rules Engine makes this quick and easy.

We have found that the seven variables typically used on the Currency Alliance Rules Engine can be managed in a matter of minutes, yet generate an almost infinite set of rules to influence customer behavior in different ways depending on amount spent, sales channel, time of day, tier level, etc.

Retrofitting desired changes into older systems can take weeks to program, and prioritizing such changes can often take quarters to get on the roadmap.

One final comment on the Rules Engine is that, if you are trying to drive emotional engagement with customers, you will want to reward many actions along many different customer journeys. The majority of Rules Engines only deal with purchase activity, so you would need hard-code logic, or to use another Rules Engine to grant points for non-purchase activity such as product reviews, customer referrals, participation in sweepstakes, engagement in social media, etc.

Redemption Catalog

Definition: typically an online store which aggregates your loyalty program rewards, so that customers can spend your loyalty points with you, or with your partners.

Every loyalty brand has frequent customers, who accumulate enough points to redeem for valuable rewards, as well as a majority of customers that will never reach the most motivating items.

That second category still needs to be offered something of interest.

There are two different ways to do this.

Currency Alliance recommends offering loyalty currencies in complementary programs (where those customers may be more frequent), or enabling your currency to be exchanged into those programs.

In practice, most brands offer their own products or services on their own search and booking pages, and then offer complementary offerings from a program partner on a white-labelled Redemption Catalog.

Bundling a nicely merchandised Redemption Catalog has been expensive to implement for any one brand, so most loyalty programs offer a third-party Redemption Catalog framed into the loyalty platform.

Choice Hotels has done this with great success, positioning its Smart Privilege program as “A Faster Way to Rewards”, allowing customers to select perks such as $2.50 Uber credit or a $5 Starbucks voucher as they check into the hotel.

The benefits are immediate: even low-frequency customers feel the benefit of staying active in the program. Smart Privilege claims this approach has led to a major boost in enrolment[ii], as well as in engagement metrics.

A third-party Redemption Catalog makes it easier to repeat these successes in your own business.

Specialized vendors include TheFirstClub Digital Rewards – “low cost, high value snackable rewards, allowing brands to say thank you easily and often to anyone”.

The platform can be white-labelled under your brand with a custom URL, and you can deselect content categories that you don’t think will appeal to your customers.

Merit Incentives also operates a rapidly expanding set of redemption options for customer or employee incentives. They operate primarily in the Middle East and North Africa where sourcing attractive rewards can be challenging for brands outside the region.

TripGift (worldwide) and The Rewards Factory (South Africa), offer similar capabilities.

There are two advantages to working with such a supplier.

Firstly, they handle content aggregation and fulfilment, saving brands a major headache in catering for large numbers of low-frequency customers – whilst still ensuring those people are made to feel special.

Secondly, now that most brands are migrating to accrual and redemption based on revenue, the flexibility of these platforms enables you to convert the value of points to fiat currency at the moment of redemption.

In short: you treat points more like money, and redemption opportunities become infinite – helping you cater for the greatest possible number of customers, with the most relevant rewards, based on the most recent data, at the most profitable value every time.

As an aside, brands which wish to create totally bespoke experiences may decide to use any ecommerce platform.

Really, though, that level of investment is likely to be better funnelled into bigger rewards for customers – a free supermarket shop, free flight or free hotel – which can be processed through your existing transactional environment.

Maintain competitive edge

At the current rate of technical change, it is mission-critical for brands to be able to take full advantage of new technologies, and new insights, as they emerge, pursue testing and trial new approaches in order to maintain a competitive edge.

This simply isn’t possible with a bundled legacy loyalty system.

Consider AI.

Most CRM and campaign platforms are now incorporating varying degrees of Artificial Intelligence (AI) into their platforms, with great success.

One study (admittedly sponsored by Blueshift, a vendor), identified a 310% increase in customer engagement in campaigns supported by AI.

A separate Adobe survey found that brands using AI tools to create personalized customer experiences were 50% more likely to significantly exceed their business goals.

Like most progressive marketing tech, most AI tools coming to market are lightweight, flexible solutions designed to be as easy as possible to trial, deploy and integrate with your existing systems.

Existing, monolithic loyalty tech providers will doubtless build AI or machine-learning tools into their platforms, but it would be a shame to have to wait – not to mention, get locked out of the wide range of different, exciting new technologies appearing on the market because you are wedded to a single technology supplier.

For the greatest flexibility, agility and customer relevancy, brands should operate five complementary, but distinct loyalty modules: working in unison, with data insights being shared between each one, and used to inform and shape a wholly more effective, inclusive loyalty strategy.

It is also vital that successful loyalty brands align their loyalty strategies with their wider business goals.

Data from across the business – both marketing insights, and business-centered information such as inventory, demand and other indicators – must be used to grow a loyalty program that appeals to more customers, and drives a whole range of desired customer behaviors beyond simple transactions.

This will never be achieved by remaining entrenched with a monolithic loyalty platform, where data can’t get in or out, and where you remain dependent on an expensive supplier to action any meaningful change.

The proliferation of loyalty microservices is a clear sign of the direction the market is taking.

Meaningful case studies may be few today, but that won’t last, as brands begin to experience the benefits of a more agile, intelligent loyalty strategy – enabled by agile, intelligent tech.

The choice is a simple one: migrate to loyalty microservices, or risk getting left behind.

Start upgrading your loyalty technology platform today

Tied down by your loyalty platform?

Currency Alliance can help.

Our core business is in loyalty partnerships: allowing brands to issue the loyalty currencies most desired by customers. Many partners have integrated into our platform in 3-5 days; and with a single integration, can access a rapidly growing network of partners with whom they can collaborate to meet customer desires, while capturing richer customer data to really understand lifestyle preferences.

Currency Alliance is not opposed to legacy technology.

In fact, we can enable those platforms to be seen as much more flexible – simply by adding a layer of cloud-based, flexible technology in front of them to enable greater collaboration in broader ecosystems.

Currency Alliance continues to be the only provider of a microservices Points Bank platform that can stand alongside, or work in unison with your existing Points Bank. The platform also includes an enterprise-scale loyalty Rules Engine for your partners that do not have their own loyalty system.

This can set you free to choose the CRM, Campaign Management and Redemption Catalog options that best serve your business.

Our platform is basically a tool kit to help you build a highly differentiated loyalty ecosystem that will appeal to your frequent and less frequent customers.

Try Currency Alliance for free today.

References

[i] https://techcrunch.com/2016/01/23/get-small-to-get-big-through-microservices/

[ii] https://hospitality-on.com/en/worldwide-hospitality-awards/choice-hotels/choice-privileges-loyalty-program-relaunch