7 Loyalty Trends for 2025: Fads, Fundamentals and Innovations

The loyalty trends for 2025 – much like the loyalty trends for every other year – are not necessarily equivalent to what brands should be prioritising in the next year. Your priorities depend on your state of evolution with loyalty marketing for your unique business.

After 35 years in the technology business and the past 10 years in the loyalty sector, I have come to the conclusion that there are few annual trends that are strong enough to take your eye off the fundamentals.

In loyalty, the fundamentals are to deliver consistent value and a consistently good experience to your customers – which is why our jobs are so important. Delivering customer value and a good experience derives partly from things that impact the whole business and not just the loyalty program. All businesses should be focused on getting all relevant data in an actionable state, with the right analytical tools, based on the right set of goals and objectives to remove friction from your customer journeys.

Every business unit should also be experimenting with AI – to gain greater efficiency, improve personalization, and reduce fraud. Broader than AI, brands should be upgrading their technology so that it works better for all stakeholders, and supports continuous efficiency improvements in operations.

But these are so fundamental to any business that they can hardly be considered loyalty trends – and anyway, no mix of technology, team skills and budget will achieve the mission if the objectives are not clearly defined.

Rather: there are fundamental things that every loyalty program needs to get right. On top of that foundation, there are tools and tactics which can be deployed to drive unique types of customer engagement, depending on a company’s industry, target customers, degree of competition, and budget for rewards. As mentioned, the timing of such developments may fall in one year or another, depending on the state of evolution in your loyalty program – and depending on the nature of your industry.

The trends we’ve picked for 2025 are:

- enhancing data security and fraud controls

- personalization taking place along extended customer journeys

- emotional loyalty expanding alongside transactional loyalty

- rewards at lower price-points as brands court the infrequent customer

- faster, lower-cost redemptions including the use of vouchers for instant gratification

- technology reducing friction around loyalty engagement and points transactions

- POS enhancements boosting loyalty for retailers and CPG/FMCGs

Many of the things that others call trends often turn out to be fads – such as the hype around blockchain and loyalty tokens back in 2018 (none of them survive today), or NFTs from a couple years ago (there are opportunities for Web3 solutions – but they are likely to remain niche). To be clear, I believe there is a role for blockchain in loyalty, but not usually for customer-facing functionality.

So in this annual compilation of trends, we identify those that are fundamental to operating any sound loyalty solution, and those that might help with further differentiation.

As you can see, few of these are new. In fact, many programs have been working on these opportunities for years. However, we consider them trends because the technology to enable them is now more readily available, and they are increasingly important to stand out in an ever-more noisy and competitive environment.

1. Enhancing Data Security and Fraud Controls

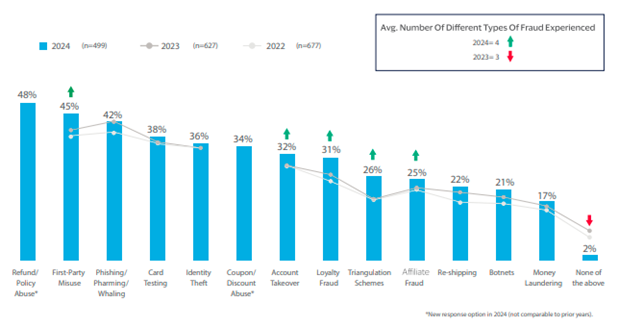

Loyalty fraud has been trending upwards for several years now. In 2024, it rose to become the fourth fastest-growing type of fraud, based on the 1,100 merchants surveyed for the 2024 Global eCommerce Payments and Fraud Report.

This is significant when you consider there are only about $0.5tr worth of loyalty currencies worldwide – as opposed to $40tr in fiat currency. So you could argue that loyalty points are overrepresented in financial crime.

Criminals are interested in loyalty points because they’re a relatively easy target – held on accounts that customers rarely log into, and protected by legacy technology platforms with sub-financial grade security.

Brands, finally, are taking the problem seriously.

This year I attended a highly useful webinar on the topic hosted by the Loyalty Security Alliance, in which Jesse Martin-Alexander did an excellent job of discussing how to balance losses from fraud with the direct costs of prevention. The $1m per month fee that some companies pay for two-factor authentication may, it turns out, actually exceed the direct costs of fraud. You can watch the recording here.

Profit and loss aside, the fact that people are now actively quantifying the implications of management and deterrence is a relief. There’s no real reason a loyalty account can’t be just as secure as bank account, and in 2025 we will see a lot of brands finally upping their security protocols.

2. Loyalty personalization taking place along extended customer journeys

Bands’ personalization capabilities have become increasingly sophisticated in recent years. Better organization of customer data, and the development of AI for customer profiling, have provided a more useful foundation for all types of personalized marketing.

As we discussed in our recent article on loyalty personalization, there are two reasons why this will lead to accelerating personalization in loyalty specifically.

One is the continuing erosion of non-consent-based marketing. While Google may have rowed back on the death of cookies, the alternatives have not proved much more interesting to customers or brands. Only about 50% of customers using Apple’s App Store have consented to tracking so far with no real indication this figure will rise. Brands are therefore increasingly recognizing that loyalty programs are the only truly effective tool at their disposal for enriching customer profiles and consent-based marketing at scale.

The other thing is the growing number of API-first martech solutions – from both loyalty tech vendors and other martech suppliers – making it a lot easier to introduce personalization to touchpoints along the customer journey.

New companies to market in the past few years include One Creation (a consent-collection app for ecommerce), Psykhe AI (a search-and-merch tool which relies on psychographic profiling) and many others. Such tools can mostly be introduced to loyalty touchpoints and redemption catalogs just as to any other app or ecommerce store.

Currency Alliance’s own contributions are our various white-label solutions for adding loyalty touchpoints to any customer journey, including a white-label allowing customers to sign into their loyalty account from any digital environment.

The critical mass of such technology now available, and brands’ much-improved data and AI capabilities, will combine in 2025 to stretch the possibilities of personalized loyalty.

3. Emotional and Experiential Loyalty expand alongside transactional loyalty

Emotional loyalty has been discussed for a few years now. The reason it’s a trend for 2025 is that a lot of brands, which cannot become as huge as American Express Membership Rewards or Hilton Honors, are nonetheless actively finding ways to court new cohorts of customers with more emotional tactics.

Some use-cases rely on GPS technology and fitness trackers. Discovery Vitality (an insurance company) and Rip Curl (a surfing brand) detect when a member is participating in sports; customers of Discovery’s health insurance products are rewarded for exercising and Rip Curl members receive points.

Emotional loyalty can have a range of other implications. It can include not issuing points at all but simply being loved by customers – as is the case with brands such as Apple and Tesla.

Being loved as a category leader is a lofty goal for any business. What most brands can do now, however, is tactically insert emotional levers into their customer experiences with the wider range of apps now available, and relying on their improved management of data.

This can allow them to show greater recognition and value to the customer in a way that feels emotionally relevant to individuals – as opposed to the broad-brush approaches that recently were the options at brands’ disposal.

4. Rewards at lower price-points, as brands court the infrequent customer

Redemptions are a primary reason why customers participate in loyalty programs – but historically, it’s been difficult to achieve any worthwhile reward unless you were a highly frequent customer. The reality is that most people simply cannot spend enough with a single company to reach the most aspirational rewards.

Now, brands increasingly recognize it’s worth incentivizing less-frequent customers to participate as well. This helps with customer acquisition and retention, and reveals potential high-spenders who were previously unknown to the business.

In July, Emirates’ Dr. Nejib Ben-Khedher explained on Skift how the Skywards team was focused on helping customer get to rewards faster. This included having accrual partners in many different categories, and ensuring that infrequent customers can find value in the loyalty program.

IAG Loyalty meanwhile reenforced the possibility of earning Avios without being a frequent flyer with a campaign titled “your everyday can pay for your holiday”. Qantas, similarly, invested $100m in making 20m additional reward seats available.

The trend towards lower barriers to participation has been playing out steadily for some years now but these announcements by three flag carriers in the same year indicate the pace of change. We’ll see this continue to pick up through 2025 and beyond. We will also see many more non-travel brands implement similar strategies and tactics.

5. Faster, lower-cost redemptions, including through vouchers

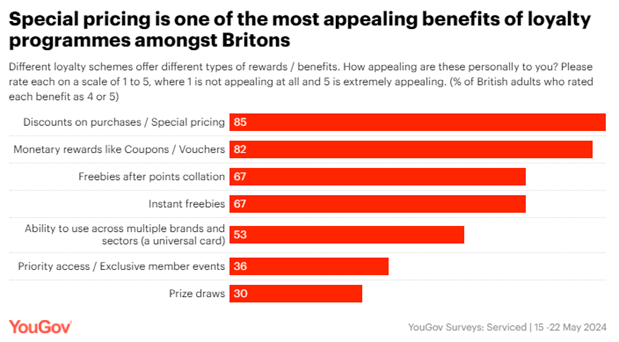

When people think of loyalty marketing, they usually think of points-based programs, but actually, customers broadly prefer faster and more tangible forms of value. A recent poll in Britain showed that, of the loyalty benefits that customers find most appealing…

“…discounts (85%) top the list followed by monetary rewards like vouchers (82%) and freebies, both after point collation and immediate purchases (67%).”

Of course, discounts and vouchers can come at a higher direct cost to the brand than points – but vouchers in particular are often used to get the customer to return because of the perceived value to the customer and their future savings.

Currency Alliance is pleased to offer one of the industry’s most advanced voucher platforms and it has been a core part of our work with Avolta, the global airport retail operator with over 5,000 locations.

But it’s also worth mentioning that we’re seeing greatly increased interest in the ability to exchange points and miles from one program into another.

This has always been a foundational component of bank loyalty programs, where card members earn points based on credit card spend and then often exchange into popular travel loyalty programs. However, now we are seeing non-travel or non-bank programs enable exchange to complementary brands because the perceived value is high for less frequent customers. Brands are finding this possibility is an effective tactic to get people to register for the program in the first place.

6. Technology reduces friction around loyalty engagement and points transactions

In order to meaningfully increase earn and burn opportunities, brands are also working on lowering friction around points transactions and loyalty engagements.

This is happening in retail stores at the POS – which we cover in the next trend – and in brands’ digital and commerce environments.

One iteration on this trend is ‘pay with points’ and in a recent article we wrote about the technology needed to enable this online and offline. This is becoming more widespread with Wayfair, a furniture retailer, introducing pay-with-points a few months ago.

One iteration on this trend is ‘pay with points’ and in a recent article we wrote about the technology needed to enable this online and offline. This is becoming more widespread with Wayfair, a furniture retailer, introducing pay-with-points a few months ago.

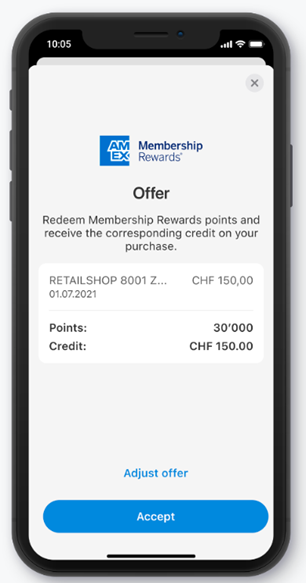

And American Express now routinely offers the opportunity to burn points in place of cash (pictured).

But we’ve also seen other reductions in friction, such as Strawberry Hotels and Norwegian Air Shuttle adopting a single common loyalty currency – saving customers the admin effort of exchanging points between programs.

Similarly, customers of Finnair and British Airways can now choose which loyalty currency to earn when flying with either airline.

This trend is accelerating because anything which saves customers time and effort is bound to increase engagement.

As mentioned above, Currency Alliance offers various white label solutions which can be added to any customer journey, and enable customers to link their loyalty accounts, earn partners’ loyalty currencies or pay with points with very little friction.

But aside from our own solutions, the costs of loyalty technology are falling rapidly, laying the ground for further evolution on this trend in the coming years.

7. POS enhancements boost loyalty marketing for CPGs and retailers alike

Whether you’re a retailer or a consumer brand, the rapid development of retail tech is good news for loyalty teams.

It used to be a retail store might only identify 25% of customers. For CPGs that figure was far lower, relying on people cutting squares out of cereal boxes, or cumbersome SMS-based promotions to capture the customer data.

Now, however, we’re hearing retailers claiming to be able to identify 90% of customers where they have the combination of a highly attractive loyalty program, and the technology needed to capture that engagement at checkout.

This is happening in various ways. At the start of this year, an interesting case study emerged from the UK where Confex and Jisp, two suppliers to convenience stores, launched a B2B loyalty program which member stores could also leverage to engage consumers. This essentially gave Jisp/Confex’s clients a reason to digitalize their customer experiences and yield shopper data that they’d never otherwise have captured.

Certainly at Currency Alliance we’ve seen lot of interest in our Universal Points Terminal. It can be introduced as a webapp in physical retail stores to identify members without the need to integrate with the POS – thereby streamlining loyalty engagement at checkout. We’ve also published two articles on the different possible ways to identify customers in retail stores, one geared towards retailers and the other for CPGs and FMCGs.

Of course, against this backdrop is a boom in retail media, where retailers are monetizing the troves of customer data they own, and the ample advertising real-estate in their physical stores. A Telegraph journalist described this as a “£2bn goldrush” in the UK, with an equivalent trend playing out worldwide.

Retail loyalty programs will probably never have the emotional appeal of travel programs; groceries just aren’t that exciting. But they have long played a crucial role in the loyalty ecosystem as ‘accrual centers’ (as helpfully described in a recent Deloitte report) which give the majority of customers the opportunity to accelerate their earning frequency.

They appear set to become only more valuable in this regard – and it’s important to state that those retailers which recognize the value of this role will benefit the most.

Retail loyalty can work for standalone brands when they have high frequency – this would include gas stations, grocery or coffee retailers, and some convenience store chains. But for 90% of retailers with lower frequency, they really need to collaborate with partners to keep their brand top of mind. And every retailer, no matter how large, will see greater returns on their loyalty investments when they’re part of a comprehensive network of loyalty partners.

In loyalty, accelerating change demands clear focus on the fundamentals

With falling IT costs, loyalty marketing is becoming accessible to many more brands (especially SMEs) which would usually fail to create a meaningful standalone program.

Some years ago, smaller loyalty programs could be effective with high frequency customers, but were pretty irrelevant for the majority of customers. Today, brands of all sizes are able to differentiate themselves in ways that makes joining even smaller programs worthwhile for the majority of customers.

This means that even a relatively small brand can achieve superb customer engagement more easily than ever, in particular by collaborating with partners.

In this context, it’s becoming more costly to get distracted by trends or fads, because this only drains resource that you could otherwise spend making genuine strides in the customer value that you can deliver.

Therefore, we continue to emphasize the importance of getting your data in order so you have a solid foundation to execute other tactics. Most brands are finally doing well in this area. Unfortunately, few are able to use that data to drive personalization at scale – so much of the work over the next few years will be on improving the ability to really understand the uniqueness of individual customers and make that insight actionable for personalization to work.

Beyond those top priorities, the majority of companies are planning to re-platform or significantly enhance their loyalty system over the next 3 years. While this is not a trend, it will require a good deal of effort, the right skills, and the right mix of technology partners to make the transition as smooth as possible.

With the right technology stack, you can ask better questions of your technology and data and get much better answers to implement and automate campaigns that move the needle on customer engagement.

At the end of the day, building a great loyalty program with a great ROI is like building a house. You can choose construction materials of varying levels of quality, but if the foundation is not solid, it is difficult to construct a loyalty program that can survive and evolve over many years to come.