In Mobility, Loyalty Strategy Will Decide Who Wins

Last December, a McKinsey report said that 2018 represented…

“…a tipping point from thinking, talking about, and planning for future mobility to implementing it….when the automotive and mobility industries shifted from a driver- or owner-focused value proposition to a customer-centered one; and when micromobility started to scale up.”[i]

Of course, until a few years ago, there was no “mobility sector”. Consumers thought about cars and mass transit, while manufacturers of transportation assets thought about market share.

Now, the mobility sector is understood to comprise every transport type that enables customers to get from one place to another and – more importantly – how customers search for, book, and manage their mobility choices.

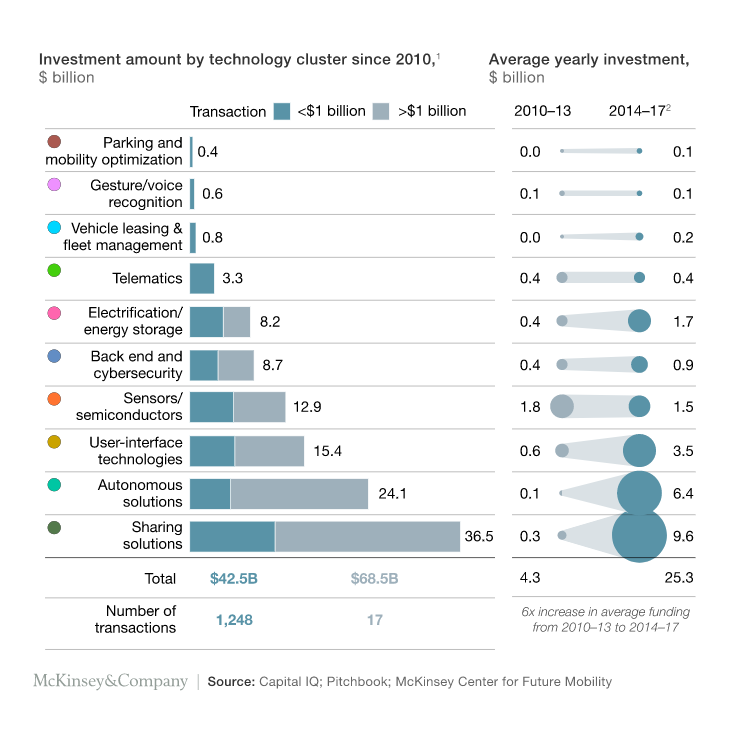

Tellingly, the greatest investment in vehicles has not been in how the vehicles move, but in “sharing solutions” – with a 32x increase in investment over the 7 years to 2017.

With growth, comes competition.

With growth, comes competition.

The rapid evolution of the supply chain has allowed a few exciting technology companies to grow fast in recent years, unencumbered by irritants such as competitors, defined standards, and complex legacy priorities and business practices.

This phase won’t last.

The evolution of mobility into a homogenized market is fast approaching – at which point, any service that is not comprehensive will get discarded or end up focusing on a niche. Independent of market positioning, unique customer insight will become the primary competitive advantage.

Few brands have yet appreciated that, as this blossoming mobility marketplace becomes highly competitive, strategies and tools will be needed to capture this insight, maximize customer retention, and minimize CPA – not just in their existing spheres of control, but across every channel that funnels customers to their service and keeps them engaged.

Enter: loyalty marketing.

This article describes why a Loyalty Strategy will become the only long-term, sustainable point of differentiation in the mobility portal wars, because sufficient capital will find innovative growth companies and legacy players will eventually learn how to become more agile.

In 3-5 years’ time, the market leaders will have emerged, so now is the moment to include loyalty mechanics to get the upper-hand.

Competitors that don’t figure out these basics will simply disappear.

The battle to provide the mobility marketplace portal

I’ve been working on mobility solutions since 2012, when I was Group Director of New Ventures and Innovation at eDreams ODIGEO.

We discovered 6 years ago that during the customer’s trip, the most value we could provide after selling the airline ticket was to show alternative mobility options in the traveler’s destination.

It was a profitable discovery. The customer appreciated our help in navigating unfamiliar environments safely, while still having an element of choice. Local providers, in very opaque foreign markets, were prepared to pay us to bring them business. We also learned a lot about customer preferences based on their choices.

This introduces a crucial concept: the booking portal.

Over the past 25 years, intense battles have been fought for flights, hotels, rental cars, activities between suppliers and aggregators. Brands which were not even in the travel industry before the late ’90s quickly became a customer’s primary provider (think Expedia or Booking.com) because they were able to pull a vast array of inventory into their search and booking platforms.

Now that much more ‘last mile’ inventory is available via API, comparable marketplaces for mobility are emerging rapidly.

Available inventory of ride sharing, scooters, bikes, trains, buses, and parking is getting exposed via APIs, and we may see Deutsche Bahn, Emirates, British Airways, Marriott, and Tesco all vying to stay top of mind by helping customers get around.

Why? Customers want choice.

Just as in the travel sector, providers of the mobility ‘search and booking portal’ will end up having the greatest influence on customer choice, and extract the highest margins as this sector matures.

But providing choice alone is not enough. Thousands of online travel agencies have come and gone over the past two decades – because they didn’t get the funding, agility, or customer-centricity right.

That will play out in mobility too.

Apple, Uber, or Airbnb could leverage their experience building two-sided markets to also be relevant players – but these brands’ tenure in loyalty marketing to date is very basic. In my own meetings with them, they’ve shown very little interest in how the loyalty industry is transforming, or what it will look like in five years’ time. Perhaps they’re victims of their own success. It’s easy to become complacent as a high-growth business, and senior executives at tech startups are mostly not remunerated on their ability to spot the second or third bounce of the ball.

Facebook did a great job at seeing the implications of market shifts, for a while. Now, even they are vulnerable.

So who will pounce?

We know Daimler, Volkswagen, Ford and a few other major brands are fighting for position as this industry unfolds. Manufacturers and logistics incumbents, such as FedEx, Hertz and UPS, could leverage their experience with fleet management and dot compliance (but customers don’t care about fleets, so they will need to figure out how to transfer these competencies into a service offering).

In a mobile-first, customer-centric world, there may be thousands of companies that want to provide that one primary mobility portal that customers have space for on their phone’s home screen.

Over time, these millions of customers will eventually migrate to one of a dozen global solutions that reach critical mass, but that basically all end up looking the same (just like we have seen in travel).

The one thing that will differentiate each provider will be the unique customer data they capture from every touchpoint, and how they put that data into action to deliver a compelling enough value proposition to keep the customer coming back time and time again.

Building such habits is precisely what loyalty programs do.

The massive potential of loyalty marketing in mobility

Historically, loyalty programs have proven very effective at capturing and retaining share of wallet when customer frequency is high.

Many people need to get from one place to another twice, four times, even ten times per day.

This is much higher frequency than customers have with their supermarket – where we find customer engagement levels in the loyalty program as high as 70-80%. Higher frequency in mobility should lead to record levels of loyalty activity with the right mechanics and mix of partners.

As autonomous vehicles, bus journeys, trains, car sharing, bikes, scooters, and other forms of mobility become aggregated and accessible to customers through a single search and booking portal, a single go-to portal to solve all national and international transportation needs will become the holy grail.

A customer travelling from Grand Central Station to the New York Stock Exchange could use the same service to get to the Hilton in Des Moines, Iowa.

Furthermore, your thinking need not be restricted to mobility features alone. Similar to how Google and WeChat already help customers discover virtually any service that meets a need, a single mobility portal may find it can coordinate much more of a customer’s out of home activity: helping customers shop, do business, or be entertained.

Imagine the personalization possibilities if the mobility operator knows a customer’s brand preferences (because they have the geolocation to where a customer travels), the frequency with which they visit retailers or professional service providers, etc. They will also know the available time between A and B in which they could be pushing relevant content.

Capturing this insight, beyond the customer’s movements, will depend on collaborating with complementary brands, and issuing a popular loyalty currency.

Indeed, the most effective loyalty programs depend heavily on collaborations with partner brands across multiple sectors that are relevant to the customer.

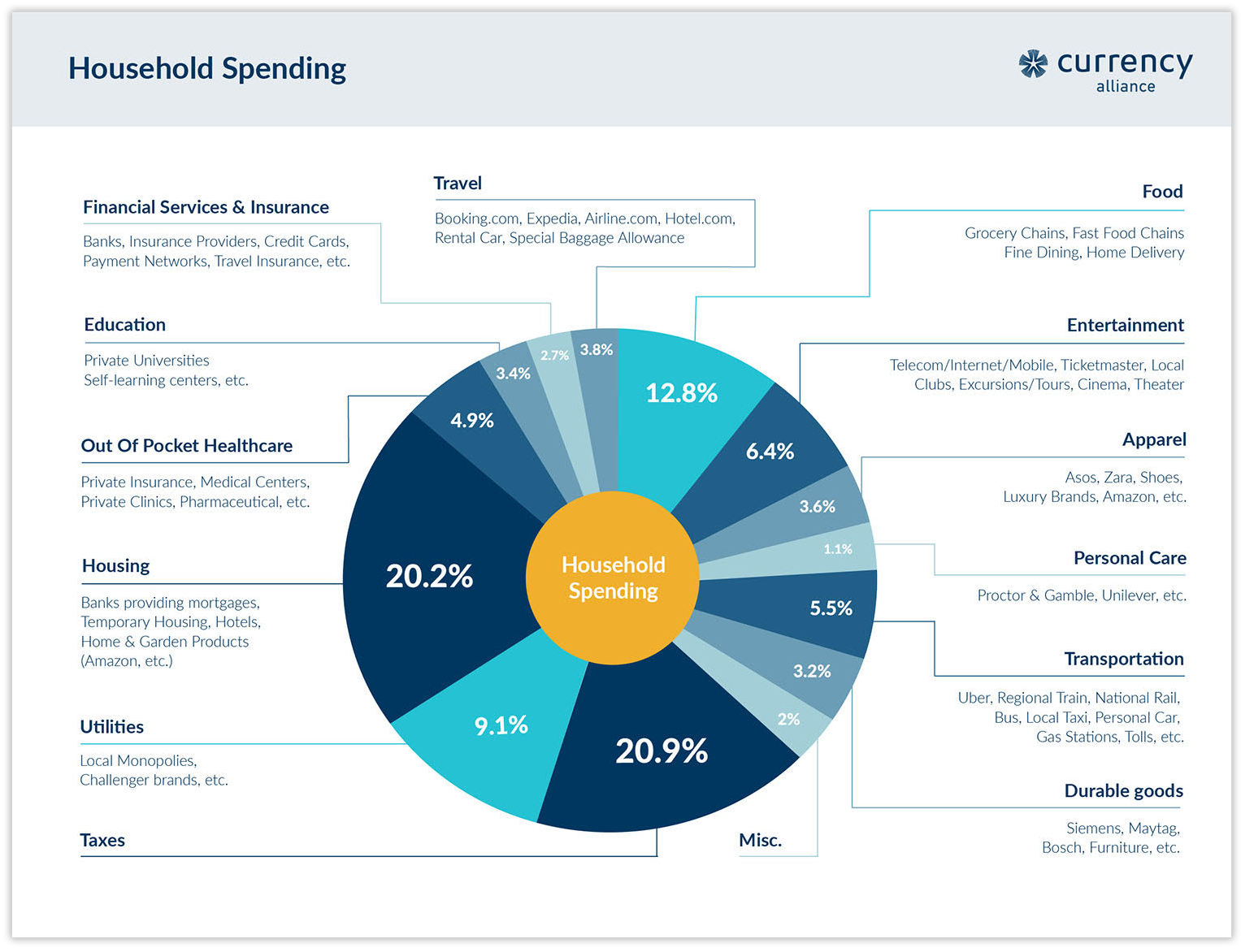

This image shows spending categories relevant to most consumers.

The mobility operator of choice may be able to create the greatest stickiness with customers by partnering with complementary brands – around a common loyalty currency – in most categories.

That will influence their behavior, which directly increases your revenue while reducing cost.

35 years of experience with modern loyalty programs proves that customers will opt in to such a program and allow their data to be used for a better customer experience.

This puts the portal owner in an immensely powerful position, with considerable influence over what services are actually used to get people from A to B. Waze, the navigation app now owned by Google, offers a window on this future, feeding advertising and recommending services whenever you stop in traffic.

Moovit, Rome2Rio, and other way-finding services actively push partner offers to captive users – which is both useful and generates revenue.

A loyalty strategy for mobility

The idea of a “Ford Points” currency might seem like a left-field idea to some, but it’s already happening. In India, car manufacturer Maruti Suzuki has launched an “Autocard” loyalty program[ii] in order to cope with the challenges of an increasingly competitive market.

Unlike in mature markets where brand loyalty is high, India’s passenger vehicle market is still evolving. Consumers are lured by price, value for money and fuel efficiency rather than brand loyalty.[iii]

Maruti Suzuki has clearly recognised that differentiation within their own mobility service will only get them so far.

As providers copy each other’s tricks, and as the costs of comparable services become roughly the same, portal operators need more intelligent ways of capturing the unique customer insight necessary to creating personal experiences that bond a person to a brand.

Loyalty currencies are a vital piece of the puzzle, serving three purposes.

First, they enable liquidity, operating as common denominators in complex marketplace relationships between brands.

These relationships, between brands which collaborate to create greater consumer value and relevance, are a crucial part of any modern loyalty strategy.

As a mobility brand, I would want a C-Store in my coalition – to know if a customer is buying gas, but not using my core services. I would want a Costa Coffee as a partner, so if the customer bought coffee far from home but did not use my services to get there, I would know it and possibly take action.

And, I would want telecom operators, grocery stores, restaurants, and personal health providers in my network to better understand lifestyle preferences – so I could personalize engagement in the most meaningful way.

With all these very different brands collaborating in one loyalty program, a single loyalty currency enables businesses to connect a customer to every collaborator in the ecosystem, augment the capture of relevant data in payment processes, monetize more than just your core business, and keep score of participation in the loyalty program.

If I could not get a complementary brand to use my loyalty currency, I would at least want to enable exchange between the currencies to enable the sharing of insights and deliver higher perceived value (utility) to the customer.

Watch the Loyalty Debate in full here.

Second, points carry emotional sway.

They are a simple, easily-understood way to participate in a loyalty program, often expected by frequent customers. As the customer accumulates points, they tend to get locked into a preferred program, even exhibiting quite irrational behavior at times, just to get to the next tier.

In fact, many airlines make more money from their loyalty programs than they do from ticket sales.

Third, they can create a significant perception of value: the “magic” of making rewards appear more valuable than the cost of the points to partners.

Imagine if a person could earn the same loyalty currency at dozens of suppliers and retailers – representing 80-90% of their discretionary spending.

This would allow customers to earn $25 to $50 worth of loyalty value per month simply by concentrating their shopping among mobility program partners.

One dollar of discount or cashback is worth exactly one dollar. However, loyalty points that cost a partner one dollar could be made to appear like they are worth $1.25 or $1.75 or even $2.50.

The winning mobility operators will create the ecosystem through which customers can get an extra $100+ per month in perceived value.

And that will keep the majority of customers loyal.

So which loyalty currencies should a mobility provider consider?

There are no great, global loyalty currencies today, although the largest airline and hotel programs have good ones.

In all probability, we will witness an early proliferation of proprietary loyalty currencies – such as Suzuki Maruti’s Autocard points – while other mobility providers opt instead to join V2.0 coalitions owned by brands in other sectors.

Over time, based on the frequency around mobility, and the probability that mobility operators will be truly global, a number of mobility-related loyalty currencies could emerge as the most useful and valuable – starting a massive migration from more limited programs.

Controlling that currency would be a hugely desirable position, but you can also maintain a highly profitable business as a collaborator in somebody else’s program.

Mobility is not a winner-take-all sector, but building loyalty with customers will be key in reaching and retaining a top-ten position – because of the data and ability to influence habits.

As long as you participate in some way, you’ll be able to reward your customer with points, gain an excuse to increase touchpoints, capture better data, and maintain a profitable position for your brand.

The shake-out

Any business active in this space still has time to carve out competitive advantage.

Uber created great enterprise value by being first-mover, but most first-movers are often not long-term survivors.

Google search appeared long after Lycos and Yahoo.

Amazon had no place becoming the world’s leading online retailer, when you consider that the first ever online order was placed with Tesco via Teletext in 1984[iv].

And the original hype that Uber would dominate ride-sharing has simply not panned out because the sector is so enormous and complex. There is a massive proliferation of transport services taking place worldwide.

Over $2.5b was spent by Mobike and Ofo in the past 3 years on bike sharing. Byrd, Scoot, and others have raised over $1b for scooters. Much of that money is gone with little market share to show for it.

So how will one brand get ahead?

As markets mature, major providers tend to master the basics, and subtle differences in functional similarities begin to disappear.

The question then becomes how to differentiate in a crowded market – and this becomes more easily done through experiential differentiators.

To return to the example of Amazon, it did this by occupying the territory of a marketplace enabler, getting many people to buy into the convenience of shopping less and buying more. Now, although most people know Amazon does not always have the best prices, the time it saves people is worth paying a little more once in a while.

Doubtless, the same will happen in mobility.

People travel for only three reasons:

- a need – to get to work, pick up the kids, buy groceries

- to communicate more effectively – visiting family, friends, or business associates

- for wellbeing – to reach a destination for fulfilling experiences

…but within those fairly basic reasons, there are countless differences which can be utilized to alter perceptions of value.

The opportunities to ride in a vehicle with more or fewer fellow passengers, in a vehicle with a classier marque, or to drive yourself rather than be driven, all come to mind.

Some value could even be created for free – such as only sharing with people who want to work in silence, or with people who agree to not wear noisy headphones or eat on the ride.

Travel is characterized by so many, highly personal preferences, that any single provider may struggle to meet them all on their own. But a mobility portal could ‘know’ their customers well enough and access enough inventory to appeal to a very wide audience by creating a highly differentiated, experience-based offering.

And that customer insight would not be known by competitors.

Two great brands already doing this in the travel sector are Emirates and Etihad.

The UAE is a tiny market (however wealthy), so these airlines depend on attracting loyal travelers from their destination markets (i.e., where Delta, Lufthansa, and Singapore Airlines operate). The only way to get a German to fly Emirates most of the time is to offer them more value.

So rather than compete on price (like Ryanair), these airlines choose to compete with their loyalty program and their product.

Hotels.com is another great example. They enable comprehensive search, three-click booking, and loyalty value worth about 10% of the nightly hotel rate.

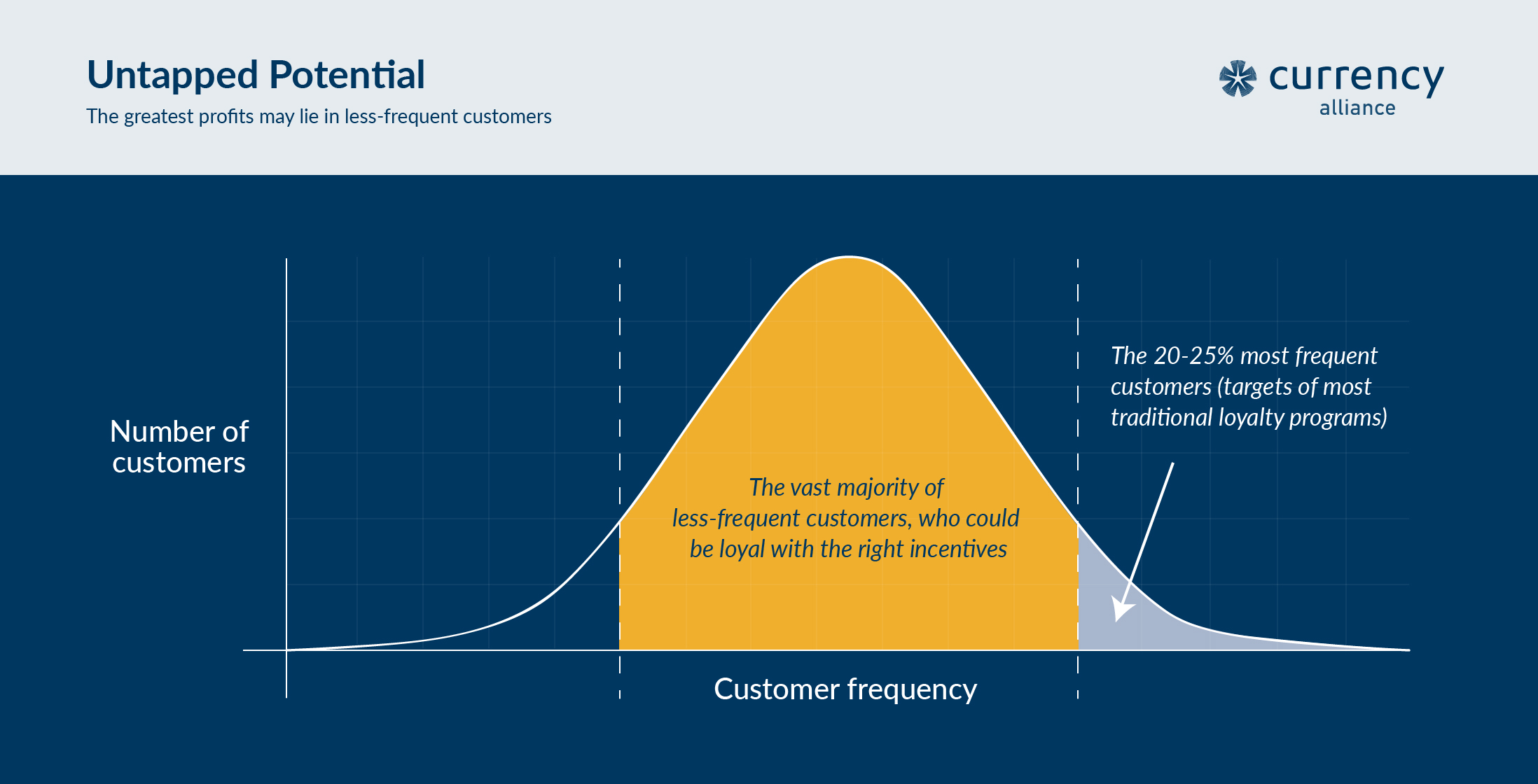

In reality, few examples exist of companies that produce this magic. This is largely because existing major loyalty programs – much like Delta, Hilton, or Qantas – are making so much money, they’ve deprioritized trying to enrich their ecosystem to be more meaningful to their mid-tail and longer-tail customers. This limits their insight about customer lifestyle preferences beyond their most frequent customers.

The likes of Uber and Lyft are at risk of falling into the same trap.

Next steps for mobility companies that want to win

We can already predict that Google (because of Maps), Tencent (because of WeChat), and Alibaba will control about 50% of customer search for mobility alternatives (i.e., the entry point).

But where is the line that Google must not cross with their transit services? They clearly help people search for transportation alternatives today, but can they direct bookings to a preferred supplier, become a broker, take payment, operate the fleet of autonomous vehicles, or even own the fleet? At some point, such a monopoly would get broken up.

In reality, based on learnings from other industries, fewer than five companies will capture at least 10% market share – and everybody else will fight over niches based on specialization.

So the industry battle between Daimler, Ford, CityMapper, Avis-Budget, BMW, Moovit, VW, etc. will be over the 50% of the market that is not controlled by the big three.

Of course, even 2% of the addressable market may equate to $10B in revenue – so the stakes are large for everyone.

The long-term winners will have excelled at all three of the essential determining factors of success:

- access to massive capital to acquire and retain customers, as well as staying power to battle it out in a very competitive market

- an agile start-up culture to rapidly respond to market demands, integrate suppliers, as well as enhance user experience

- a customer engagement strategy based on broad partner collaboration around a popular and valuable loyalty currency.

The last one is currently being overlooked by existing players for two primary reasons.

For the legacy car manufacturers, it’s because they’ve never had high frequency of engagement with customers, so don’t understand the power of the data that is spun off from frequent touchpoints (and they come from a culture where loyalty programs were not core to their business). For the tech start-ups, it’s that they tend to be highly focused on the technology platform and marketplace content as points of differentiation – believing the “product” is more important than the customer relationships.

These perspectives create a huge blind-spot for nearly every business trying to gain an advantage.

Although legacy loyalty programs in other sectors are only designed to be relevant to customers making purchases five times per year, a great modern loyalty program can inspire loyalty in infrequent customers as well.

And a mobility firm could sell their points to partners, in exchange for highly detailed customer data, and thus make great profits on infrequent customers – who may never even pay for a ride. For this large majority of customers, the value of the loyalty program exceeds the value of the brand.

Furthermore, if ‘loyalty’ did not work, the top 20 airlines and hotel chains would have abandoned their loyalty programs long ago.

Savvy operators will create an ecosystem of partners around loyalty mechanics, and a loyalty currency to not only optimize retention, but also stimulate word of mouth and cross-brand customer acquisition.

Getting this right requires collaboration across your business: CRM, inventory, customer service, etc.

It also requires collaboration with other companies in order to create new customer experiences that accelerate data-capture, and increase everyday consumer relevance in the program.

Mobility operators must decide whether they want to get ahead of the curve and take a leadership position, become a barnacle to someone else’s loyalty program, or ignore history and hope their capital or product is sufficient to win and/or hold significant market share.

Given the frequency in mobility, I would want to leverage my assets to be in the driver’s seat.

A loyalty technology platform for mobility

The loyalty industry began a material transformation in 2017 that is gaining momentum.

Brands in the past have turned to traditional loyalty program management systems to enable this vision, but at great cost.

Not only did the brand become dependent on a vendor for the heart of their ecosystem; they also ended up with customer data in multiple silos.

Besides, most leading systems were not designed to enable broad ecosystems of peers all collaborating to serve customers. Legacy systems were designed for one brand to dominate a modest set of partners that feed off the major brand.

Now, therefore, the smart money is on building a customer engagement platform from the ground up, from best-in-class microservices.

Amazon Web Services – the poster child for technology microservices – explains a raft of benefits, including reduced costs, faster lead times and increased agility.

The same will apply in mobility.

With an SaaS Points Bank and Loyalty Rules Engine that collaborates with existing enterprise CRM and Campaign Management components, the portal operator will retain the enterprise value, and not be held hostage by some loyalty vendor.

To find out more about managing your own loyalty platform, or discuss the loyalty strategy for your mobility brand, get in touch with Currency Alliance, or try the platform for free today.

References

[i] https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/reserve-a-seat-the-future-of-mobility-is-arriving-early

[ii] http://www.marutiautocard.com/

[iii] https://www.livemint.com/market/mark-to-market/toyota-suzuki-car-deals-a-boon-or-bane-for-maruti-1553653562164.html

[iv] http://www.bbc.co.uk/news/magazine-24091393