8 loyalty trends for 2024: intelligent, data-led marketing

Loyalty trends, as we’ve said in our previous years’ trends articles, are interesting to think about – but they are not necessarily reflective of what your own brand should be focusing on in the next year.

To consider a loyalty topic to be a ‘trend’, it needs to be on the roadmap during 2024 for at least 25% of leading loyalty programs and on the radar for at least 50% of companies. These topics should be of interest for all loyalty marketing professionals, but depending on where you are in your loyalty journey, they may still not be priorities if you still have basic requirements to get in order. Such priorities might include getting all your data in one place, adding data security measures, or deploying modern campaign management capabilities.

So, at the end of this article, I’ve proposed an exercise which you and your team could use to refine your loyalty strategy for the next year – which I believe you will find simple, useful, and interesting. You can skip down to those recommendations here.

This year, a continuing key theme in loyalty will be the ability to drive even greater customer value at lower direct cost. That was also a theme last year – but as we discuss in this article, two things have changed.

- the economic outlook – which is actually gloomier than it was last year due to ongoing inflation in most large economies. That is driving brands and customers alike to be more earnest in the pursuit of value

- a significant acceleration in the deployment of more cost-effective marketing and loyalty technology. The ability to target investment more precisely, with less wastage, and greater certainty of a positive customer experience, is steadily removing a lot of the uncertainty and risk around brands’ marketing ROI.

So, our 8 trends for 2024 are based on intelligent, data-led marketing – which naturally should lead to lower costs, in a way that lays the groundwork for brands to build more meaningful relationships with their customers.

Let me repeat that: all the top trends are related to leveraging data to create value – so I hope you have your data in order. And, since Currency Alliance is not in the data management business, I hope these trends are considered as unbiased.

Those trends are:

- a resurgent trend in coalition loyalty

- identifying customers across touchpoints with less friction

- ongoing shakeup of loyalty tactics in grocery and retail

- composable loyalty unlocking many more touchpoints

- modern technology enabling more precise targeting of loyalty investment

- an adverse economy shaking up customer lifetime value

- brands working harder to push experiential rewards

- predictive analytics, supported by AI.

Deployment of member engagement solutions in your loyalty program are likely to combine several of these trends in a single project.

Many of the trends from last year…

- the rise of chief digital officer and other professional technology buyers

- loyalty personalization

- digital CX innovation

- the rise of loyalty fraud

- B2B and SME loyalty programs

- less excitement about crypto

… are all still highly relevant; it’s simply that the emphasis has shifted. Loyalty personalization has been subsumed into a wider conversation about data actionability. B2B and SME programs are now more established, but their evolution is within the context of the resurgence of the coalition loyalty model. Crypto (and NFTs) have become a fringe experience where the hype outstrips results; blockchain remains interesting – but won’t be widely adopted in loyalty for at least another 3-5 years.

As ever, it’s worth emphasising that customers become loyal to a brand because of two things: value and/or experience.

They almost never become loyal because they earn a lot of points – although they may appreciate the rewards you enable them to earn.

These are foundational principles for all loyalty professionals to keep in mind as they are considering the loyalty trends, and their individual loyalty strategies for the coming year.

Focusing on saving customers time and money, while associating your brand with positive experiences will always be key objectives.

Everything you prioritize depends on the unique context of your business.

A resurgent trend in coalition loyalty

Loyalty coalitions have been a dominant model of loyalty marketing for twenty years, usually with an expensive intermediary in the middle of the ecosystem, that did not fulfil its data-sharing promises.

That came to the end of its useful life during the past 5 years – as evidenced by Nectar in the UK, Plenti in the USA, and Aeroplan or Air Miles in Canada. Such coalitions that still exist in Spain, The Netherlands, various countries in Southeast Asia, etc., that have not reinvented their business model, are still limping along, but with modest engagement.

But in 2024, loyalty professionals will be shocked – albeit they should not be surprised – that many new multi-partner collaborations will be launched. I am aware of at least 12 major initiatives that will launch (or re-launch) with expanded or completely reinvented value propositions.

Norwegian Air Shuttle and Strawberry Hospitality Group have made public their intention to shake up their market. Air Miles Canada is certainly working on a new strategy and new tactics under its new owner. Air Miles Middle East has been upgrading its technology and adding partners.

But the bigger surprises will be in countries where coalition has been proven, but incumbents have become stale. I can’t say more due to confidentiality agreements – but stay tuned to this trend. I anticipate this next wave will transform the way brands think about the virtuous circle of capturing customer data to drive improved customer engagement.

I feel a bit vindicated, because for 7 years I have been saying that the coalition model is the winning model for loyalty in the long-term, but the traditional model had 2 of the 4 pillars broken.

Speaking in the Toronto Star in September this year, Air Miles’ Shawn Stewart neatly summed up the value of the coalition model: helping business…

“…access new customer bases while keeping the costs of running a loyalty program lower.”

The article covers the various brands which have joined the Scene+ loyalty coalition. The ‘earn and burn’ partners include Home Hardware, and also Safeway – replacing its proprietary ‘Safeway for U’ loyalty program in in the Canadian market.

Certainly at Currency Alliance, we’ve noticed more interest in coalition loyalty in the past 18 months. This article, which we wrote over 4 years ago explaining the loyalty coalition model, is more popular today than at any time since it was first released.

Brands today are increasingly aware of the power of loyalty partnerships for capturing a greater share of customers’ wallets – but, there are good reasons why they may not wish to independently operate their own partner network.

Responding to the Toronto Star article, Scene+ president Tracey Pearce said…

“…customer reach and not carrying the burden of operating their own programs is what is attracting companies to the loyalty program.”

Some brands may also feel they’re more naturally a ‘burn’ partner in someone else’s program (Scene+ also includes dentists). They may also wish to test out loyalty marketing for 3-5 years before going it alone – in light of examples such as partners leaving Germany’s Payback.

If you’re considering joining a loyalty coalition or operating one, as do many brands in travel, retail and financial services – there are a few things to keep in mind.

It’s tempting for a coalition operator to become greedy and use its position to command a disproportionate amount of the customer value. This undermines loyalty; it’s a strategy that sank Plenti – American Express’s attempt at a coalition – in 2018. The value generated in the coalition should have been more fairly distributed among stakeholders to drive frequent customer engagement.

Brands will also typically not own the majority of data when they join most coalition programs. This fundamental problem of the old model is front-and-center in all the new initiatives I am aware of, and Scene+ seems to have cracked that requirement or expectation from partners.

Importantly, these historic pitfalls are no longer to be taken as a given thanks to technology advancements.

A coalition operator today can have the privilege of orchestrating a network of collaborating brands, and earn reasonable profits, while enabling KPIs that are attractive to all stakeholders (and not just the central brand acting as dictator). Airlines should take note of this, as their extremely successful programs over the past decade will be under threat going forward if they don’t realign with the partners who have contributed to their success.

Nor is it any longer a requirement for a coalition to embrace a single loyalty currency. Partners can have their own loyalty programs and points/miles, yet participate in a broader loyalty ecosystem where points/miles can be redeemed across partners, earned across partners, or exchanged.

Brands of all types should want their loyalty currency to be the most valuable in their ecosystem – but they should also be willing to offer whatever points/miles the customer values most. I believe we are on the verge of a new trend where retailers will participate in many loyalty programs to access new customers by doing just this.

Issuing multiple loyalty points/miles was incomprehensible in previous years because of exclusivity clauses, arrogance, or integration challenges, but now most retailers are becoming customer-centric and treating the cost of points as a cost of doing business. They should not care what points get issued because that cost is almost always less than they pay for cashback schemes, affiliate marketing fees, Google click advertising, or discounts.

As brands continue to seek low-cost, low-risk ways to increase customer engagement, we can expect interest in coalition loyalty to trend upward through 2024 and well into the future.

Identifying customers with less friction

A good reason why retailers may not have joined a loyalty coalition is that it can be difficult to identify customers at the point of sale, capture data for themselves, and reconcile the realized value between partners. However, recent technical advances now make it much easier to resolve each of these possible challenges.

Last year we reported that ‘pay with points’ would be a trend for 2023. That turned out to be correct, as a growing numbers of brands introduced technology which made it possible to burn points at various different points of sale, online and offline.

This has been technically possible for over a decade, but there are now, more affordable ways this can be achieved.

An attractive method – though previously quite expensive for the brand – is where customers can simply pay with points at checkout. The prediction we made last year was proven right in 2023, when Amex Membership Reward Points became available in Australia as a method of payment on Myer’s online sales channel.

This built on prior implementations where customers were able to link their AMEX, Citi, or Chase accounts with Amazon in the USA. Once an account is linked, Amazon customers (and members of the card scheme loyalty programs) can apply their balance in points, at a value defined by the card schemes, toward the cost of a purchase. Hilton and a few other programs also started working with Amazon.

These setups, however, will have relied on expensive hardcoded integrations between the points of sales and the loyalty program.

Card linking – where you rely on the payment network to inform you when a registered card number is used at one of your locations – has continued to gain traction worldwide, though it remains relatively expensive.

Through 2024, we expect to see continued innovation, whereby loyalty points can be accepted as payment at little or no upfront cost, including in offline settings.

Mobile wallets present an interesting opportunity to identify customers without friction. Since customers are spending using their mobile wallets anyway, this makes it a zero-effort solution for the end-user; they simply need to add your loyalty card to their wallet of choice. The question for the loyalty program is whether they operate at sufficient scale to manage integration with the various different mobile wallets in their market.

If you want to learn more about identifying the customer at checkout, we produced an article on the topic which you can read here – as well as a dedicated piece on pay-with-points, here.

Ongoing shakeup of loyalty tactics in grocery and retail

We normally would not cite a trend in a specific retail category, but given the frequency and magnitude of spend in grocery, as well as lessons learned that are relevant to most loyalty marketers, we wanted to share the following insights.

The trend in ‘pay with points’ is closely related to widespread changes in the grocery sector, where many large retailers experimented with discount-based loyalty initiatives in 2023.

Instant discounts from a grocer, based on what is in your shopping basket, can deliver exceptional value. However, this has not all gone smoothly for many brands. Reasons have included poor CRM capabilities hindering customer profiling, mismatches between what the customer wants and what CPGs/FMCSs are willing to fund, and complications with self-checkout terminals.

Automated checkouts, which serve as the loyalty touchpoint in many supermarkets, are being reconsidered due to their impact on the customer experience.

Booths – a high-end British supermarket – recently removed most of its automated checkouts, citing poor customer experiences. In the US, Target is experimenting with restricting self-checkout to baskets of fewer than 10 items, for similar reasons.

The right solution for most supermarkets is probably to have a few staffed checkouts for people who want them. That means you can’t rely entirely on the self-checkout screen for loyalty engagement.

You can also debate the merits of forcing customers to log into an app to take advantage of the best loyalty offers. For some customers, this is a helpful feature; others will forget, others simply would prefer not to.

Furthermore, customers also appear to be pushing back against the widespread introduction of members-only discounts which began around 18 months ago.

Ikea recently abandoned its 5% in-store discount for Ikea Family members, shifting its strategy back to everyday low pricing. And regulators are investigating whether Sainsbury’s and Tesco used their own changes to mask price increases.

In truth, a lot of supermarket prices were going up anyway due to high inflation. But this should still be a wake-up call to loyalty teams, as it shows that customers are suspicious of the use of novel tactics being used to motivate additional spending.

One survey respondent said…

“I don’t mind member-only pricing from a selfish point of view, but think it’s very discriminatory and morally questionable.”

Retailers should, and will continue to experiment and innovate to different approaches to in-store loyalty through 2024.

It’s too early to predict a winning formula, but on the technology side, it’s likely to be one that makes loyalty engagement almost effortless for the customer. On the promotion side, retailers need to ensure they issue loyalty rewards, rather than punishments for non-engagement. The latter is a poor customer experience, with a high risk of undermining loyalty to the brand – especially at a time when many brands are trying to capture more share-of-wallet from less frequent customers.

Composable loyalty unlocks many more touchpoints

We have seen in 2023 (in fact during the first 3 years of this decade) that brands are adding loyalty mechanics to drive customer engagement across many more customer channels, and touchpoints within those channels.

This has been possible partly thanks to improvements in brands’ technical architectures. Composability has been gathering pace as partnered solution vendors have greatly improved and simplified their APIs (and created tools for managing APIs), making digital transformation steadily less daunting.

This is effectively moving the loyalty program from being only transactional and rewarding spend, to much more of a centralized strategy to encourage the entire customer journey with your brand and influence desired outcomes. Another way to think of it was that ‘loyalty’ was a function in many companies like a barnacle on a ship. In recent years, leading brands have repositioned loyalty as the motor of the ship itself.

For example: incentivizing a customer to reveal their purchase intentions, introduce a friend, or complete a review would previously have been technically difficult. Those simple actions, however, can have a material impact on the business. Now, without much cost, the tools that enable those actions can be more easily be integrated with the loyalty platform, and most touchpoints can leverage loyalty mechanics to move the customer along desired journeys.

Through 2024, we will steadily see more connectivity between loyalty platforms and composable tools for ecommerce, content, product, social commerce, customer service, POS – etc. Loyalty will thus encourage customers to serve themselves in more efficient ways that reduce friction for all stakeholders. The result will be better value, and better experiences – which are the foundation of loyal relationships.

A positive move in this direction was Air France-KLM adopting Contentstack, in 2023, “to provide seamless and curated omnichannel experiences to its customers worldwide.” The many new customer touchpoints united under this system can now become loyalty-enabled at a lower direct cost than otherwise would have been possible – helping the loyalty program appeal to more customers, more efficiently.

Composable systems also make it much easier to accept points value as the method of payment. Modern payment gateways can accept many more forms of value, including points/miles, and in a composable architecture; ‘pay-with-points’ is just a plug-in.

As a sign of what’s to come: Primer, a composable checkout vendor, is presently working on a loyalty API, so that it can add loyalty programs among Google Pay, Adyen, PayPal, and the many other payment methods it enables for brands.

Over several years we’ll reach the point where every customer touchpoint with the brand can be loyalty-enabled. That won’t happen in 2024 but this will be the year where that really picks up steam.

Modern technology enables more precise targeting of loyalty investment

The theme of our 2023 trends article was ‘a year of cost-driven innovation’. True enough, many programs cut new initiatives in 2023 as a cost-savings measure, but in some cases, this also reduced customer engagement.

Costs should absolutely be controlled, but the best area to make savings is in your daily operations and infrastructure, since this often has little impact on your customers. Furthermore, 1 dollar of incremental revenue might be worth 10 cents in profit, but 1 dollar in savings is worth the full dollar in incremental profit.

So, cost control will remain a theme going into 2024 – but with a greater focus on customer value.

The good news is that innovative technology is making it possible to greatly reduce wastage on loyalty investment, both with regard to the targeting of offers, and the reduction of operational costs.

Improving the targeting of offers

As loyalty technology integrates more effectively across your technical architecture, it is becoming a lot easier to use data from across the business to better inform your loyalty investment.

For a long time, loyalty pricing has been determined by inventory and demand – two solution categories which are becoming a lot more efficient thanks to improved data analytics and AI (see the AI discussion below). If you can integrate customer-facing systems with your loyalty platform, your dynamic pricing can fluctuate with far greater precision in order to optimize ROI.

Brands are also increasingly getting their product data better organised in modern PIM solutions (here’s one example from LeMieux, a British luxury brand which adopted the Akeneo PIM). This is improving the ability to show relevant promotions to customers in different marketing channels – and reduce advertising waste by reducing instances of showing the wrong product to the wrong customer.

The value of these efforts can double or triple when you invest in modern technology throughout the martech stack. It could increase ROI by 10 times for those brands still using the Siebel loyalty solution from Oracle – which has seen little enhancement for a decade and carries the indirect cost of paying license fees for the Oracle database(s).

All of this can contribute to more effective marketing automation – a good way to reduce cost, while increasing member engagement. If you have spent recent years getting most of your customer data into one platform to improve analytics, modern tools can use the resulting customer profiles to drive personalized campaigns.

Reducing operational costs

This includes license fees, maintenance fees, or change request fees paid to vendors. The cost of loyalty and marketing technology has come down a great deal in the past 5 years, while newer platforms have much more functionality. This means that if you are paying more than $250,000 per year in fees to one or more vendors, you can almost certainly save at least 50% of that while enabling new functionality. That new functionality can be entirely controlled by the marketing team without dependency on the IT department or vendors.

This is accelerating off the back of ongoing modernization in the martech stack. In 2024, we expect to see this paying off in the form of greater availability of marketing budget for customer incentives.

Those companies that started this migration to modernize technology in the past 2-3 years will certainly start seeing the ROI in 2024.

An adverse economy shakes up customer lifetime value

In 2024, marketers of all disciplines should be keeping an eye on Customer Lifetime Value (CLV) across all their current and past customer segments. This is due to significant, ongoing unsteadiness in the global economy and peoples’ finances.

Covid, the phase of revenge travel, remote/hybrid working, and the way new technologies are affecting people’s daily lives have all had impact on customer behavior, long-term loyalty, etc.

Importantly, these trends are in flux. The jury is still out on what the long-term impacts will be, but consumer spending remains suppressed, and companies’/countries’ maturing loans are being refinanced at much higher interest rates than had been anticipated. That implies significant risk of spending being further curtailed in 2024.

This is important, because if customers become more frugal, many brands may lose sight of the spending habits on branded goods which they currently rely on as a measure of a valuable customer.

You probably have a good idea of the CLV for your most frequent customers, but you can also acquire more share-of-wallet among those in the mid-tail and longer-tail. This can be with simple value enhancements, such as bonus points or discounts on the goods a customer needs to buy – which make it more likely the customer will add other items to the basket when they visit your store.

Brands are already courting the long tail with renewed interest. Recent changes to Delta’s Sky Miles program upset a lot of high-spending loyal customers, as the brand made it significantly more difficult to attain the highest statuses in the program. But far from being simple cost-cutting: this change coincided with increasing the relative value of points issuance for credit card spending, via their partnership with American Express.

This has shifted loyalty investment away from rewarding already-frequent customers, and towards discovering new customers who have the potential to spend more with the brand.

The goal is to engage more, less-frequent customers at lower cost. This has been best-practice loyalty strategy for a long time, but the economic outlook for the next year indicates it will move further up the agenda at most brands.

Brands work harder to push experiential rewards

Speaking of incentives, there has been a clear trend for over 5 years in members’ desire for experiential rewards – things that create memories that hopefully link to your brand. These could be travel-related, cooking classes, meet-and-greet with personalities, private shopping, early access to new products, etc. Some of these could affect hundreds of members at one time and have very low cost of delivery – so you create a significant step-up in perceived value with little cash cost.

Tesco does an excellent job at this – where members can redeem £2.50’s worth of points for a Pizza Express voucher worth £7.50. Tesco might only pay Pizza Express £1 for these redemptions, but Pizza Express is happy to have the vouchers issued all day long – because they know when a customer visits their restaurant, they will probably come with 3 other people and spend £50-60 total – on mostly high margin drinks and food. The net discount of £6.50 therefore generates about £25 in contribution margin, and gives their team the opportunity to win over new customers with their service and food.

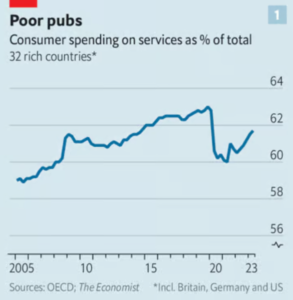

Related to the comments about the economy above: brands may need to invest further in these offers if consumer spending really does decline during 2024. Ever since the covid pandemic, consumers have been leaving the house less often, leading to a global decline in spending on services totalling $600bn a year (while spending on goods remains the same).

Related to the comments about the economy above: brands may need to invest further in these offers if consumer spending really does decline during 2024. Ever since the covid pandemic, consumers have been leaving the house less often, leading to a global decline in spending on services totalling $600bn a year (while spending on goods remains the same).

Experiential rewards have been a major cash cow for loyalty programs in recent years thanks to high emotional appeal and modest direct costs. In 2024, loyalty incentives will increasingly focus on building emotional engagement with customers – and given the economic outlook, experiences may be even more appreciated as rewards.

Predictive analytics, supported by AI

Most of the discussion around AI in 2023 has been about generative AI, but in loyalty, predictive AI actually stands to deliver far more interesting gains for brands.

Generative AI is a useful productivity aid, but loyalty has no particular productivity challenges that you wouldn’t find in other industries, and that other technologies cannot solve at lower cost.

Predictive analytics, however, have a far more interesting part to play, in an industry where the application of incentives, based on demand, can produce millions in revenue off the back of small percentage gains.

There are 3 main applications of predictive analytics in loyalty.

1) Better customer profiling to improve personalization

For example, very rarely do two trips have the same objectives, involve the same people, or comprise the same modes of transportation. Given the infinite possible combinations, AI has the potential to help travel companies tailor offers and messaging to individual customers’ personal goals, and their probable lifetime value.

In this context: instead of the traveller or their travel agent searching around 20 to 200 alternative options for a given trip, AI could do much of the analysis, so the traveller can simply choose one of the 3-4 best alternatives presented. As this happens, customer behavior shifts from ‘search’ to ‘selection’ – and all those brands that are not positioned well for bots to understand what they offer will be excluded from the consideration set.

Beyond booking trips, AI has the potential to improve the targeting and personalization of a wide range of other brand engagements, and increase the utility of data that these interactions yield.

Brands typically sell hundreds or thousands of items, whereas customers are usually only in the market for a few products or services at any point in time. AI will allow brands to evolve from ‘spray and pray’ marketing, to placing products or services directly in the path of the customer’s journey. This will probably increase conversion by orders of magnitude, helping reduce wasted marketing budget and surgically optimizing ROI.

The ability to process detailed data to anticipate the customer’s needs will also be useful for tackling other challenges common to loyalty programs.

One of these is churn, where customers have been in the brand’s same segment for an extended period of time, but their lifestyles, jobs or priorities have changed. By processing a wider range of insights on customers, AI can help identify which are at risk of churning, and which are worth nurturing in order to regrow the customer relationship. Data from partners can be a firehose of useful insight about a customer’s true lifestyle preferences because customers will be engaging with partner brands in different ways, and the insight from beyond your four walls can dramatically improve effective personalization.

2) Operational monitoring to identify and resolve problems more quickly

Many capital-intensive businesses, including airlines, hotels, or mass retail stores must staff departments for peak demand. Peaks may only happen 5-15% of the time, which means organizational capacity is beyond the necessary level 85%+ of the time.

In aviation (and similarly in most sectors), these peak periods are characterized by increased workloads around routine customer problems. Examples include rebooking customers when they are going to miss a connection, or answering questions during moments of disruption.

Currently, the complexity of these tasks means they depend on human management, but the greater data processing capability of AI would allow many of them to be automated. Furthermore, AI could help to fine-tune each response by treating each customer based on their value to the business.

Even if people only make a mistake 0.1% of the time, this is still 1 mistake for every 999 correct actions. If a business is handling 2 million touchpoints with customers every day, that is 2,000 mistakes per day – all of which affect real people trying to achieve their personal goals. If AI can reduce your mistakes from .1% to .01%, that delivers huge benefit to customers, while reducing your operating costs.

Comparable operational improvements can be made across many other areas of a brand ecosystem, such as fraud monitoring & prevention, and sentiment analysis on social media, online chat, reviews and surveys.

Analysing and actioning all this information at scale would be impossible for humans and require too much data processing for conventional technology, but AI could be used to identify and flag human errors – and in some cases even take corrective actions immediately as they occur so problems are avoided altogether.

3) Better-aligning the targeting of offers to maximize ROI

Brands are still heavily relying on first-party data on a customer’s direct spending – i.e., whether they buy from you frequently – as a determinant of whether that customer warrants special attention in the program.

Of course, one of the main purposes of partner collaboration in loyalty is to help brands identify these customers outside of their own ecosystems and draw them into their own environment. For example, a customer who earns points/miles from a fuel retailer where they put premium gas in their car at least once per month is far more likely to respond to upgrade offers – because they obviously have discretionary income.

The challenge, as loyalty programs’ partner networks become larger, is managing the growing amounts of data they collect from such partnerships, and using that data to optimize ROI at scale.

AI algorithms should be designed to train on partner data. in addition to your own data. The resulting models will indicate how to best engage with segments whose interests are more varied and complex than those of your most frequent customers – but who probably share similar characteristics.

*

Nearly every company will continue investigating how AI can help their business in 2024, but those brands that benefit in the short-term will be those that focus on specific use cases and build accurate business cases that include the true cost and risk of using AI at scale. As you proceed with your AI initiatives, don’t forget to factor in the cost. Most AI platform vendors today are subsidizing the cost or covering it entirely, but that is not sustainable. One day soon, the users of AI will have to start paying $1 to $8 per query/result.

We also need to remember that AI is still in its infancy, and most brands’ technical architectures are still too inflexible to really capitalize on the technology. Notably, a Google search for ‘AI loyalty case studies’ produces a lot of predictions of how the technology will be useful in the future, and no evidence of real-world deployments.

Brands are now investing in the data stack at pace, however – so it would be surprising not to see a number of interesting stories about AI loyalty emerge in 2024.

You can read our full article on AI in loyalty here.

Setting your loyalty strategy on the right path for 2024

This article is not supposed to be an exhaustive list of trends; simply the most useful ones for brands to be thinking about in the coming year.

For instance, one that we chose not to include was freemium/premium or subscription programs. These are still popular, but most brands offering something that can be packaged as part of a subscription have already implemented these solutions – so I would argue this has gone from a trend to an established practice.

Regardless of the trends, the most useful thing a loyalty team can be doing is considering how to optimize customer value and customer experience in the coming year, since these are the key drivers of loyalty.

To refine the list of all the possible things you could do next year, down to the things you must do to keep your loyalty program interesting for members, I suggest this simple exercise.

Start by assembling a team in a meeting room with a whiteboard, and drawing a line down the middle so there are two blank sides.

On the left side write “Value” at the top and on the right side write “Experience”.

On the left side, make a list of all the things your brand can do for customers that increases the value they obtain from your company. This should be a long list, not just 3 or 4 items – because the top 3 or 4 things are probably also being done by your competitors. You still need to do these to keep up with the competition, but it will be the ideas in the second half of a long list that can really differentiate your brand.

Then repeat this process under the column for experience. Again, make a long (and maybe even crazy) list of ways you can improve the experience. This might be an AI module that helps customers create their weekly shopping list, or a gamified solution that puts a free item in the customer’s shopping basket, based on the data profile of that customer.

Once this is done, then start thinking about the loyalty trends for the last few years, and the technologies that can help you deliver on those value propositions. Think about how you could enhance an existing plan to deliver more value or a better experience. Consider how some new opportunities could be delivered with partners, or which could deliver greater impact than existing plans.

Then rank-order the opportunities and start to evaluate the cost, effort, skills, and dependencies so you can build a business case to gain approval to execute the initiatives that will deliver the best results for your program in 2024 and beyond.

Keep in mind that your members are time-starved, so any way you can remove friction from their engagement with your brand – across all touchpoints – will improve their experience. At the same time, you can easily waste large amounts of budget and time on flashy or trendy initiatives which the customer simply can’t make time for – or on fads that will pass in a few months.

By the end of this exercise, you should have produced a shortlist of experiences that you can practically deliver on, that make the customer actively want to do business with you, and where the value for the business and customer can accumulate over time.

This exercise could be worth repeating every 3-6 months because the market in which you operate is constantly changing, as are your customer’s expectations. If you don’t evolve with the trends that are relevant in your sector, your customers may find greater value elsewhere.

Anyway, if you made it to the end of this article, I hope you found a few nuggets of value and some actions you can take now.

If Currency Alliance can be helpful in your journey to deliver excellent value, I welcome the opportunity to answer questions, and perhaps help you figure out how to maximize your loyalty ROI.