Loyalty partnerships: how to optimize your partner mix

There can be many goals for establishing loyalty partnerships, but the optimal partner mix should usually be based on three objectives:

- increasing customer frequency and engagement, by expanding the loyalty program’s service offering or creating greater choice and freedom in how members earn and redeem their loyalty value

- capturing insightful data about members when they are interacting with partners to improve profiling and personalization

- generating incremental revenue to subsidize the operating cost for the loyalty program operator by selling points to partners.

It has been my opinion for the past 10 years that creating a network of partners to support almost every type of loyalty program is the key to long-term success and creating value for all stakeholders. The reason is that customers just can’t spend enough with most individual brands to ever get to interesting rewards. With partners, however, a company can keep customers engaged on a weekly or monthly basis and stay top-of-mind when customers need more of your product or service.

The purpose of this article is to discuss what mix of partners might be best for achieving these goals in your loyalty program. Or, if your company has lower frequency of customer purchases, it’ll illustrate which other loyalty programs you might collaborate with in order to offer common customers the points/miles they prefer to collect.

We organize the key insights into three main sections:

- introducing the concept of ‘the partner mix’ and why it’s important to consider this alongside the value of individual partnerships

- the ‘partner mix playbook’: the criteria for selecting partners, which you can use to brainstorm a long-list, and narrow down a shortlist of companies you’d like to collaborate with

- some considerations, steps, and best practices in implementing partnerships and maintaining them long-term.

Much of this decision-making should be financially led, and influenced by predicted engagement metrics. But it’s also important to apply some emotional reasoning and creative thinking to defining the partner mix and implementing partnerships to maximize impact with members.

Loyalty programs are increasingly evolving from the historical earn-and-burn model (i.e., transactional), into more experiential or lifestyle programs, and trying to connect their members to memories that reinforce the affinity to their brand. Affinity and loyalty come from emotional engagement – which could be from amazing redemption experiences, or simply removing friction to streamline every interaction and helping to save customers time.

That means the mix of partners should include brands that fulfill a functional need, as well as those which are fun for customers to engage with – all while driving improved ROI for your business.

The importance of getting the partner mix right

Individual partnerships may serve specific purposes, which we will cover in the next section. But first, let’s discuss the concept of ‘the partner mix’: why it’s important to have partners in multiple business categories, and how this helps brands fill in gaps in the customer profile – that ultimately helps with personalization.

Why it’s important to have partners in multiple business categories

In most cases, the majority of customers simply do not shop with any one brand frequently enough to earn enough points to reach interesting rewards. But if they can earn the same points across many different brands, they can get to meaningful rewards in less time. Delivering rewards reinforces the virtuous cycle of motivating customers to earn more points/miles within that ecosystem of collaborating brands.

If a customer cannot earn about $25 USD per year in a loyalty program, they won’t bother joining in the first place, or they won’t remain active. The $25 in reward value does not have to cost $25 – as explained in our article on introducing dynamic loyalty value – but this is kind of a benchmark that most loyalty programs should strive for. I would wager that, if you look at your membership base, at least 50% of those who have been active in the past 90 days are earning more than $25 per year in benefits. The vast majority of members who have not been active in the past 90 days are sitting on a few hundred or few thousand points, not engaging because they have determined it is unlikely they would ever get to an interesting reward.

How partnered brands complement each others’ strengths

The optimal mix of partners will depend on the sector in which your business operates, since businesses in certain categories will have different customer frequencies (which enable accelerated earning) and emotional appeal (which makes the earning worthwhile).

For this reason, partnerships are common between high-frequency (but arguably boring) categories, such as grocery and credit cards, and exciting, low-frequency businesses in travel and entertainment.

But both frequency and emotional appeal are subjective – and there are businesses which don’t fit easily into one category. Consider clothing retailers, home décor, pet care, healthcare, and car maintenance, where some customers may shop frequently, and others rarely or never.

So what businesses really need is a broad mix of partnerships in different categories, to broaden the reach and appeal of their loyalty program across a wide range of different customer preferences.

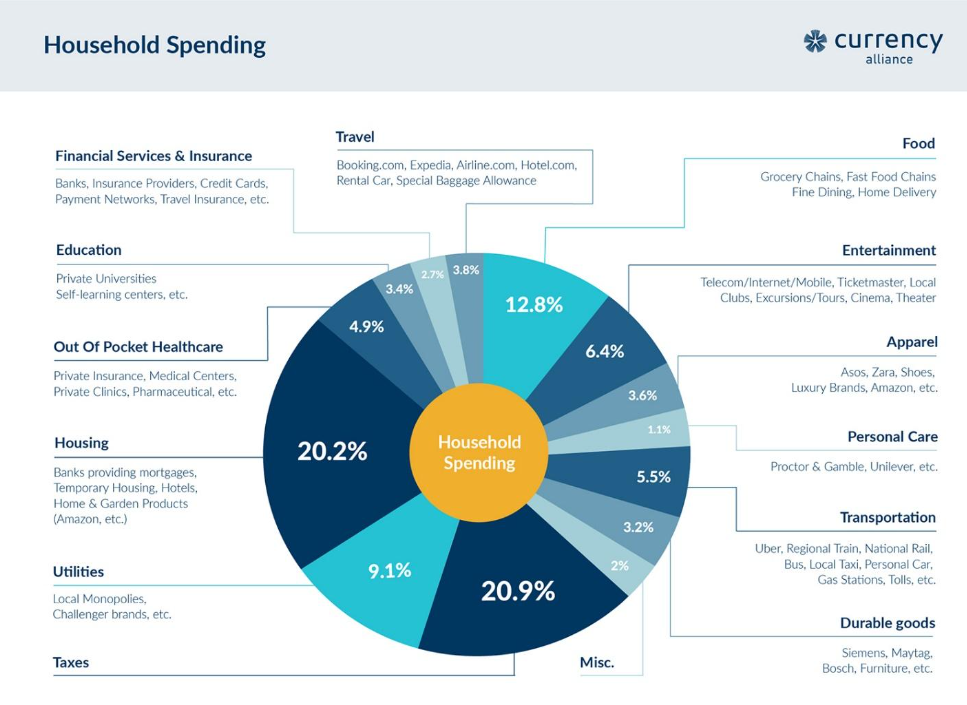

In the chart below, we show the typical categories in which customers spend money. Your company is in at least one of these categories, but probably not three or four of them. But if you have partnerships in nearly all of these categories, then your loyalty program can influence where your customers shop when they’re not shopping with your brand.

Those partners will appreciate the incremental sales achieved from your customers. By collaborating with you in loyalty marketing, they probably reduce their cost of customer acquisition and retention, so it should be easily to build a business case to fund incentives. Similarly, it is almost certain the partner has many potential customers, who are not familiar with your company, but who would consider your brand if your company were promoted via their communications channels.

Therefore, rational companies would invest from 1% to 5% of their incremental sales in issuing your points to common customers, as this will probably be less expensive than cashback, affiliate marketing schemes, discounting or paid search.

Filling in gaps in the customer profile

In addition to adding engagement frequency, partnerships can reveal very interesting insights about your customers’ lifestyle interests, disposable income, and demographics.

For example, if you can find out that your members buy premium food brands or put premium gas in their car at least once per month, then you know they have discretionary income and/or appreciate quality. If they buy pet food or children’s products frequently, you can be fairly sure they have pets or kids. Importantly, if they buy something for a child infrequently, they might be buying gifts for friends, so be careful about jumping to conclusions.

The ’partner mix playbook’: criteria for selecting partners

There are various functional and regulatory considerations to establishing a broad partner mix and these are outlined in the next section.

But this article is primarily about marketing, so in the context of optimizing loyalty ROI, this section serves as a playbook for the selection process for loyalty partners, based on five key factors.

Company culture and alignment on objectives

Most loyalty teams probably start their selection process for new partners based on the business category, i.e., deciding to partner with an airline. But actually, that should not be the first step in your thinking.

The most important aspect of effective partnerships is alignment between the companies around their goals and objectives. That might mean they have complementary target customer profiles, geographic focuses and marketing capabilities or channels.

From my experience, company culture and company values can also be important in some types of partnerships, because they define how a brand communicates with its target customers and how engagement techniques are deployed.

A collaboration between Ryanair and Four Seasons Hotels would not work because they have entirely different goals and methods of achieving their objectives. Dollar Tree in the USA might align well with Spirit or Frontier Airlines, but probably not with Delta or Marriott.

Company culture also affects how companies treat and recognize customers. Hilton Hotels is unlikely to partner with Ryanair because of the conflicting nature of their price point and the intended customer experience.

Similarly, every 4 or 5 star hotel group should want to work with Enterprise Mobility because of the white glove treatment and frictionless service they can offer customers depending on the brand (National, Enterprise, Alamo) and their passion for delivering value. Furthermore, Enterprise is likely to have rental locations in city centers where nicer hotels are located.

The wider implications of these cultural differences can be financial in nature. Dollar Tree’s business model and cost structure might prevent them from offering 1% of a customer’s purchase amount in Spirit’s loyalty currency. However, True Value Hardware might be an interesting partner because they are trying to capture market share from Lowe’s and Home Depot.

The following three criteria all relate to the nature of the data you want to collect via the partnership.

Geography: being where your members visit

Your earn or burn partners should be within the same footprint as your own businesses. For a grocer or a bank, that ‘footprint’ will likely be national or statewide. For a coffee chain or convenience store it may also be national, but the business would benefit from a cluster of more local partners in order to influence customers to stop by as they run their daily errands.

Some businesses such as Tesco grocery operate different loyalty programs in each country. In such cases, the mix of partners should predominately be within the country where your grocery stores are located.

For a travel brand, of course, that footprint would often be global or based on their flight network.

For an airline loyalty program like Emirates Skywards, collaborating with complementary brands in the UAE will be important, so you can influence behaviors in your own market and when a customer is planning a trip.

But with a single loyalty currency everywhere in the world, your airline mission may be to connect travelers from Asia with the Middle East, Europe and North America. So, you would also want accrual and redemption partners in your destination markets, discouraging customers from travelling with competitors, and hopefully revealing insights when they do travel with someone else.

Similarly, Melia Hotels could collaborate with Scandic Hotels since their overlap in geography is less than 2%, but Nordic consumers love visiting the Mediterranean and a portion of the Spanish/Portuguese/Italians like to spend their summers in cooler climates. Hotel groups with a strong regional focus could collaborate with similar hotel groups in other regions (like code sharing agreements between airlines) so common customers could earn points across the partners in their favorite loyalty program(s) when visiting other regions.

For airlines and hotel groups, having partners in destination markets will be the top priority over the next few years. Most of these loyalty programs have reached a saturation point for membership growth in their home country, but have more than 50% of total loyalty program members in other countries. To tap larger growth opportunities outside their home turf, they need accrual and redemption partners in those countries.

Tapping into specific audiences

Loyalty programs are uniquely useful for helping brands tap into other brands’ audiences. This is valuable for two reasons.

The first reason is to find more customers who match your existing ideal customer profile (ICP), whether they’re value-conscious customers, upper market consumers, or people with luxury tastes – and various other demographic parameters. It’s easy for brands to conclude which partners have a similar ICP in order to attract more similar customers. Just ask your members where else they shop.

The other reason, however, is to find people who do not necessarily match your ICP, but who still carry out significant spending in your business category.

Many people switch between good-value and luxury brand propositions depending on their lifestyle intentions or the state of the economy. As suggested above, an offer from Spirit Airlines for shopping at Saks Fifth Avenue may only resonate with a tiny percentage of Spirit flyers. An offer from Ford Motor Company, however, to provide 2,000 United Airlines MileagePlus miles in exchange for taking a test drive of the new Explorer, will likely resonate with people who live outside large cities.

The crucial thing to understand is that there could be many more atypical customers for your business than typical ones – they’re just a lot harder to identify. Partnered brands need to ensure that the value of products or services offered resonates with their common customers, while also ensuring a broad spread across different types of businesses. That can allow them to tap into specific audiences they otherwise wouldn’t reach.

Skift recently reported on this strategy being deployed by well-known hotel groups…

“Sonder runs many properties in residential neighborhoods where it’s hard to open new hotels, so Marriott has extended its reach through a tie-up.

Similarly, Small Luxury Hotels of the World also has luxurious properties in tiny towns, villages, and remote resort areas where new hotel creation is difficult. So Hilton’s deal with that collection of hotels extends the group’s reach.

“Partnerships are also partly about continuing to make the loyalty program value proposition relevant to a rapidly evolving customer base,” said Ramya Murali, a co-lead consumer loyalty offering, principal at Deloitte.

Sonder has a youthful clientele, and its many apartment-style properties could help Marriott stay relevant in a world where your grandma might run an Airbnb empire. Small Luxury Hotels of the World has a coveted high-net-worth customer base that seeks distinctively designed properties. Hence, Marriott’s and Hilton’s respective interests.”

Ensuring a good mix of big and small partners

There should also be some balance between scale, and the nature/quality of the partners.

Every loyalty program needs partners in spending categories that represent a significant portion of a customer’s monthly budget; this will drive the bulk of the member frequency.

But it’s useful not to be ego-driven and fixate on major enterprise brands. For many customers, smaller brands may have much greater emotional relevance – and this could help you tap into new customer demographics you otherwise may never have reached.

Historically, the cost of setting up new loyalty program partnerships was so high in terms of commercial discussions, legal contracting and IT integrations that only large collaborating brands could generate positive ROI within a year.

Currency Alliance has demonstrated that it is possible to get the setup costs close to zero. Even with medium or smaller partners, all companies can now choose the mix of partners that best meet the desires of their target customers, and ROI can still be positive within weeks or months.

The bottom-line is don’t fixate on collaborating only with large, popular partner brands. Some of these may be challenging to reach an agreement with, while some smaller or more regional brands may be loved by your target customers. Furthermore, it may be challenging to align on objectives and KPIs if the partners are too different from your market positioning.

And, if you focus only on large brands, you may be able to reach an agreement, but then they won’t put much effort into promoting the collaboration.

Best practices in implementing and running partnerships

Loyalty partnership strategies have evolved significantly since the 1980s, and while ongoing debate over best practices is healthy, there have also emerged some clearly better and worse ways of working.

It’s worth discussing these things with new prospective partners to check for a similarly progressive mindset that puts customer value at the forefront of their loyalty strategy. Those potential partners that are most closely aligned will probably have the greatest levels of customer engagement and would be the partnerships you really want to invest in.

Prioritize genuine, direct partnerships

Crucially, any partnerships should be based on real, direct commercial agreements with partner brands.

This is as opposed to those brokered by intermediaries such as affiliate marketing or gift card aggregators such as RestaurantRewards, AWIN, CJ, or other aggregators. These companies might make it look easy to gain a lot of ‘partners’ quickly and easily, but it will come at significant indirect and long-term cost.

These third parties that provide gift cards or generate affiliate marketing fees tend to consume a lot of the margin that could otherwise be funneled into incentives for your members. They also tend to hoard the data which makes it difficult to speak directly with partners and set up promotional campaigns or cleaver new marketing tactics that can help both companies.

In contrast, the great benefit of having direct partnerships is that you can work with the loyalty or marketing team at the partner to promote the collaboration and implement creative marketing campaigns to drive customer engagement (see below).

Sell or exchange points with a reasonable (i.e., modest) margin so most value goes to the customer

Historically, the KPIs for collaborating loyalty programs have usually been stacked in favor of the main entity issuing the points. In many cases the amount of data sharing to enable greater personalization has been limited.

When designing your partner collaboration ecosystem, consider that charging fair prices for points among your partners will drive more customer engagement because the customer is receiving more value. Furthermore, lower profit margins on the points will almost certainly lead to greater overall volume – which indirectly unlocks more data insights about how your members engage across your network.

Obviously the KPIs from the most visible travel partnerships have produced a net benefit for partners of the issuing brand or they would have quit many years ago. But loyalty today is a lot more competitive. This means the partnerships which leave the greatest value on the table for customers will rise to the top.

Invest appropriately in co-marketing

The benefits from partners are exponentially greater if you invest in the partnership, rather than establish a basic partnership and don’t promote it. You should tailor this to the importance of the partner in the eyes of the customer.

For example, a partner might list your brand as an accrual partner, exchange partner, or redemption partner on their website and in their apps. Something like an ecommerce product grid and some marketing automation is a starting point to letting customers know about these options, but there should be a greater effort to promote each other’s business through their owned marketing channels.

For the higher-volume partnerships with brands that have mass appeal, such as in travel, banking, grocery or similar, it could be worth investing in mainstream above-the-line marketing initiatives. You’d want to make sure everybody knows just how valuable your points are and how easy they are to earn or redeem across your partner network.

It is important to maintain open communication with partners to identify comarketing opportunities across the customer database of both companies. If you and your partner(s) don’t promote it, you will just be one of many, and the full potential ROI on the partnership may never be realized.

Set the right level of data sharing

Data sharing among loyalty program partners has been fairly limited during the past two decades beyond the amount of incentive to give common customers, but this is a major oversight. As discussed throughout this article, there is so much rich insight that partners can share that could improve conversion on selling goods of any type.

Brands are rightly sensitive about the amount of data they are willing to share, not least for the all-important goal of protecting customers’ data and preserving their trust. But having an open discussion about the potential benefits could lead to some interesting use-cases or marketing actions that would benefit all stakeholders.

Eliminate friction from partner contracting

For a long time, setting up such direct partnerships was challenging and expensive because of legal and IT constraints, as brands typically relied on 30 – 40 page custom agreements.

This has become even more complicated in recent years as new privacy legislation has been introduced.

Currency Alliance has innovated around the commercial and legal framework to establish standard templates that can be implemented quickly with little to no legal team involvement. You can find out more in our dedicated article about modern commercial frameworks but in short, this greatly reduces the effort of extending the reach of your loyalty program.

With modern technology, there’s no obstacle to brands maintaining a broad and diverse partner mix, and reducing intermediary costs so more value can flow to members.

Low friction exchange & reconciliation

Some of the largest loyalty programs in the world still require members to call a call center to ask to exchange/transfer points to a partner program. Almost no consumers today want to spend 10 minutes on the phone with someone to complete an action that should take 30 seconds in an app or website. Furthermore, if they have to wait 10 or 15 minutes just to get a call center operator on the phone, what should have been perceived as a great redemption option, will turn into an experience that reminds your members of their last visit to the dentist.

The solution to these problems ultimately lies in how (or whether) collaborating brands’ loyalty systems are integrated and how the relationship is governed.

Steps setting up loyalty partnerships

Over the past 8 years, we’ve seen hundreds of brands build thousands of partnerships using Currency Alliance to connect their loyalty platforms. Our software is self-service, so while we help to integrate between a new client’s platform and our own, we don’t usually get involved in individual partner negotiations between companies.

Nonetheless, we’ve inevitably been heavily exposed to the throes of these new partnerships and as a result, we have a lot of experience in how to select new partners and onboard them efficiently. Based on that experience, we suggest you use the following steps as a template to growing your partner network.

The earlier topics discussed are partly related to identifying where friction might appear later on, so that you can efficiently allocate energies to more productive partnerships.

1. Define the characteristics of your target segments

Discuss who you want to reach: whether it’s customers very similar to your ICP, or niche segments where you believe there could be good opportunities for growth. This will quickly help you zero in on partners in specific business categories, geographies, or those which serve certain types of customer.

2. Define your primary objectives from partner collaborations

Are you interested in customer acquisition, capturing more customer insights, increasing member frequency, or finding new redemption alternatives for your members to spend points at different price points?

3. Define how you want money to change hands between yourself and the partner

Either what you are willing to spend with partner programs – or, what you expect them to contribute towards your loyalty program. Having a template that can be shared with partners to build their business case could significantly accelerate reaching an agreement.

4. List companies in 6-8 complementary spending categories that could be partners

You will then want to rank order the potential partners to start focusing on those with the greatest potential benefits.

5. Approach the marketing department of these companies

…via your network of contacts or via LinkedIn (or ask Currency Alliance for help).

6. Reach a conceptual agreement on commercial terms

If you know what you want, then get that documented so it can be shared as part of the meeting. If you are not sure what you want, then have a more general conversation and see where that leads.

7. Share a contractual template (ideally based on Currency Alliance’s best-practice templates)

Most partnerships require some type of commercial agreement, so you will accelerate collaborations if you can propose how the commitments between companies should be documented.

8. Evaluate integration alternatives

Your IT department may have preferences in how connectivity is established so loyalty transactions can be generated between brands.

9. Define common marketing objectives and create a marketing plan

As mentioned, to maximize ROI, there should be more marketing actions involved in promoting the partnership than just listing each other on your website and apps.

10. Finalize the agreement

…and prepare for implementation.

Partnerships have historically taken 6-12 months to set up because all the factors defined in this document can take considerable time. However, if you have clear goals and objectives, rely on standardized templates, and use modern technology (or third-party services like Currency Alliance), then many of the necessary steps can run in parallel and lead to the desired outcome in much less time.

*

This document was meant to be a bit of a playbook to help loyalty marketing professionals understand what is involved in establishing effective partnerships. Hopefully it has also been helpful in considering how best to extend your loyalty ecosystem to increase opportunities to drive customer engagement.

You can find much more information about partner collaborations on the Currency Alliance website. Alternatively, contact Currency Alliance here and we may be able to share industry insights that help your company execute in a more efficient manner.