Loyalty personalization powers wider marketing efforts

‘Loyalty personalization’ implies being able to determine offers and incentives based on predicted CLV, so that personalization produces favorable business outcomes.

Really, maximising engagement and CLV is the purpose of all marketing personalization. But this is precisely what loyalty programs were originally designed for, as marketing platforms purpose-built for measuring and incentivizing customer engagement, including when the customer is not shopping with your brand.

Personalization of engagement with customers is the Holy Grail for marketers because of the impact on the customer’s experience with your brand, and the all-important ability to increase CLV.

Marketing personalization can take place within localized initiatives or channels, such as the ecommerce shopping experience, the loyalty program, or a particular marketing campaign that captures the customers’ imaginations.

In this article, we will focus a bit more on the loyalty side of personalization because our primary audience operates the loyalty programs that strive to build personal relationships through incentives.

As a consent-based platform, a loyalty program is arguably the most useful tool for powering a brand’s wider personalization efforts. The customer profiles built around the loyalty program can be used by many different teams, and in combination with many different systems, to drive meaningful engagement that increases revenue.

But everyone should remember that a customer’s loyalty to a brand is based on their overall perception of value, and their cumulative experience of interacting with the brand – through all touchpoints. This means that one approach, or one technology, or one channel will never be enough to strengthen loyalty across all customer segments.

The mix of techniques needs to be assembled in a consistent way to make the customer feel as if they are known to the brand and recognized when they engage across any channel or touchpoint.

This is now becoming achievable thanks to developments in technology and best practices in various aspects of marketing and ecommerce – including loyalty marketing where the customer should be at the center of the business.

Personalization comprises four key strategic initiatives. In this article, we’ll analyze the current benchmark for each one and examine how the loyalty program can improve on current efforts. The initiatives are:

- collecting customer data with consent, at scale

- targeting marketing messaging and offers information, based on predicted ROI

- executing this across multichannel, multi-brand marketing contexts, rather than in isolation

- measuring and optimizing engagement in a coherent way, capturing additional insightful data and producing a virtuous circle that enhances further marketing efforts.

Let me re-emphasize: relationships are built by people and through positive experiences across all touchpoints.

Fifty years ago, personalization was delivered by people who knew their customers and adapted how they interact and deliver value to build lasting relationships. For the past 20 years, we have seen a divergence between smaller businesses who are still in touch with their customers, and larger enterprises with centralized marketing functions that deploy technology to drive personalization at scale.

Somewhere in the middle are hospitality companies. Large brands like Radisson or Marriott strive to engage customers via digital channels from a centrally-coordinated marketing function, while professionals on-premise deliver a personal touch when guests are at a hotel property.

Some brands today have very powerful personalization capabilities – particularly newer ecommerce companies built around modern technology. Nonetheless, many ecommerce companies don´t emphasize the importance of loyalty marketing (beyond the health and beauty industry – where dozens of companies do this well).

The most urgent work is really needed with longer-established enterprises such as banks, grocers and travel companies. These companies operate the world’s largest and most popular loyalty programs, and yet their personalization capabilities fall short of their potential.

This could be because the sheer size of their member bases makes them difficult to manage – but also, early generations of loyalty technology restricted the loyalty teams’ ability to collaborate with the wider marketing team. Modern technology has removed this blocker, paving the way to a new, high standard of personalized customer engagement across every marketing discipline.

Loyalty personalization is powered by data collected from partnerships

Many brands today have fairly sophisticated personalization capabilities. But, even the most advanced brands usually cannot collect sufficient data to build the rich customer profiles needed for true personalization – which comes from how customers engage with complementary brands. They widely rely on the narrow slice of first-party data they obtain from their own business, or augment that with third-party data – and this can often be misleading.

For example, if I fly from Barcelona to London on Ryanair but then stay in a 4-star hotel, both travel companies think I am ‘their’ type of average customer. Neither may know that I travel to London 20 other times per year but stay at different hotels, or fly different airlines. And, neither knows whether I do any high-end shopping while in London. This type of additional information would be very helpful in their personalization efforts.

Of course, many brands today operate some relatively advanced personalization tech. This includes modern content management and marketing automation systems, which can yield insights based on the content the customer reads, even if they don’t make a purchase.

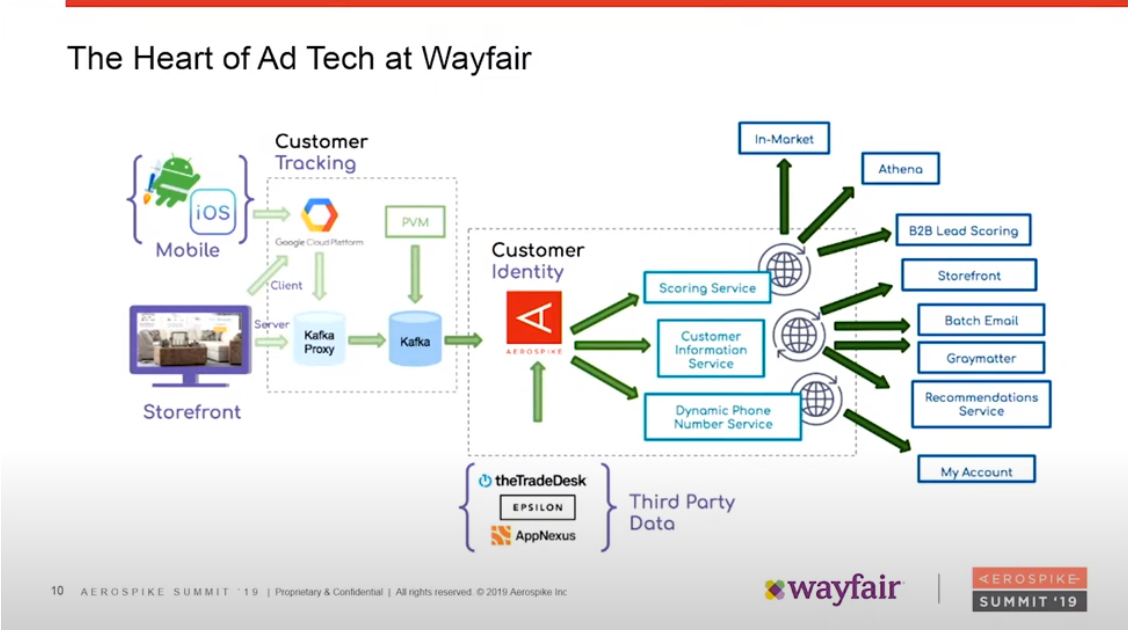

A good example is Wayfair, an online furniture retailer, which claims to enjoy 30% larger cart sizes, thanks to personalization achieved using modern martech tools. This video (from 7:30 to 9:00) and the screengrab below shows the number of different data inputs and outputs surrounding its Aerospike data platform.

This is sophisticated, but there are limitations to how much data Wayfair can collect from its proprietary environment. For instance, if two customers may purchase the same $800 green sofa, you can guess the following:

- the customer’s income level based on their postcode, if the billing address matches the delivery address – though this could be highly deceptive (i.e., if they own other properties)

- the customer’s favorite color if their browsing session shows a lot of other green products – though the green sofa could easily be a one-off.

You are, however, missing other vital pieces of information:

- the customer’s age (a 30-year-old customer will likely have greater CLV than someone in their 80s)

- whether or not the customer has kids and may be interested in children’s furnishings

- whether the customer is renovating their home and may be purchasing a lot of other furniture from competitors

- …and a whole range of other demographic information that indicates the customer’s life stage and personal preferences.

Brands in other categories, such as airlines, grocers and banks, also struggle to collect sufficient demographic information from their proprietary data. For this reason, partnership-based loyalty programs are well-established as a platform for the consent-based sharing of customer data, to help paint a more complete picture of the customer.

For instance, airline miles can widely be exchanged out of hotel programs. This may, for example, help the airline identify the customer’s income level, as many people will buy an economy flight but stay at a luxury hotel. It could also tell the airline if the customer flew with a competitor, if their points were used to book a hotel in a different country but there was no sign of the customer having taken a fight.

Whereas both hotel groups and airlines are travel brands, more revealing data can be yielded by partnerships between brands in entirely different spending categories.

Consider two customers who purchase a $400 economy class ticket from New York to Montreal, but who have completely different reasons for travel.

One is a low-income customer flying for personal reasons; the other is an international businessperson who flies regularly, usually with competitors. The first customer may never fly with you again; the other could possibly fly the same route several times a year.

The airline cannot tell the difference between these two customers on its own. But if it partners with a fuel program, and detects that the second customer puts premium gas in his car, it will increase the projected CLV of that customer. It would also suggest the customer is interested in cars and might appreciate a special offer for travel or accommodation for a racing weekend.

Partners like GetYourGuide (tours & activities), CAVU (parking), Enterprise Rental Car or Nextory (audio books for children) could share additional insights of great use to the travel brand. That would include how many people I am traveling with, whether I have young children, or whether I’m staying in the city center.

Another example of this is the ability for customers of Tesco, a UK grocer, to burn their loyalty value in Pizza Express restaurants.

How much data is actually shared between these brands would be decided between them, but with the right kind of data sharing in place, Tesco would become able to determine things such as:

- whether the member ate alone, with friends, or with family

- how many family members the customer may have

- whether or not they (or someone in their family) are vegetarian, or allergic to certain foods

- a particular wine that they enjoy (or if they drink alcohol at all)

…which could all be used to inform further marketing.

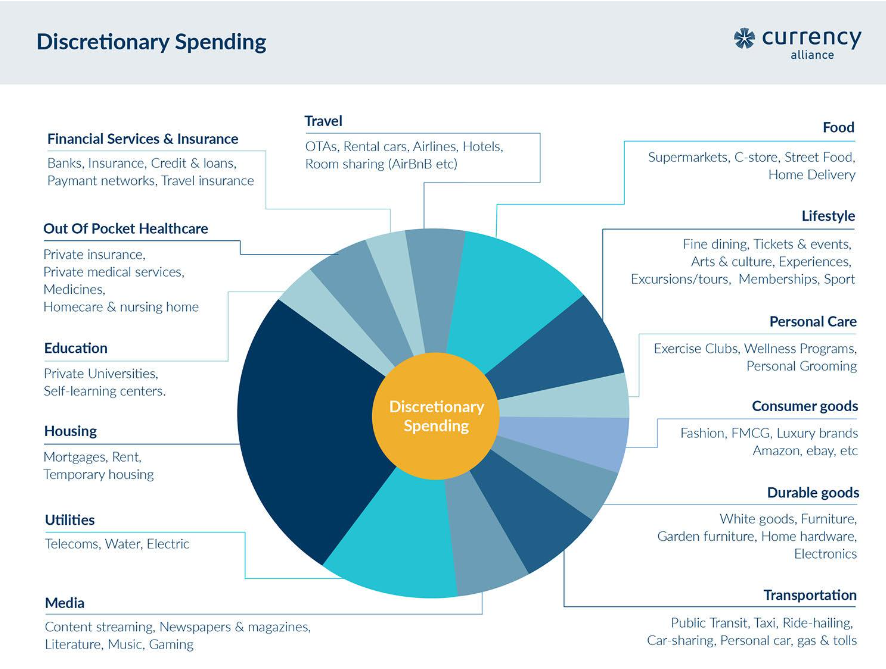

Such loyalty partnerships have been commonplace for decades. When they first came about, they enabled relatively personalized marketing – but they had ceased to be that effective. Even the most advanced loyalty programs’ partner networks only accounted for 15% of a customer’s discretionary spending until recently.

Today, this is changing as brands realize that fleshing out customer profiles in this way is crucial for personalized marketing, and so loyalty programs are seeking to add partnerships in more spending categories. Being able to collect data across the majority of customers’ spending activity should therefore be a priority for most enterprise brands’ personalization efforts.

Loyalty program data helps to personalize offers and target messaging

Brands rely on complementary data sources not only for fleshing out customer profiles, but also for targeting advertising at new and existing customers.

These complementary sources have included loyalty programs, tracking cookies, and media environments, with some brands also experimenting with directly incentivizing customers to receive marketing offers.

While the future of cookies remains uncertain, the emerging technologies being proposed as alternatives offer little improvement. You can learn more about them in this article on Martech.org but in summary, the options that have emerged are in 3 main categories:

- consent-based tracking – where users of web browsers, or of Apple and Google’s app marketplaces, agree that their usage data can be used to target ads

- contextual advertising, based on their customer’s browsing activity, and identity resolution, where you try to identify individual users across multiple environments based on things such as a ‘device fingerprint’, the IPs address, etc.

- publisher-provided identifiers (PPID) – where a media owner allows you to target individual customers based on their profile but without revealing who the customer is.

Similar to tracking cookies, these solutions all offer some basic utility in helping brands issue segmented advertising based on the browsing activity of audiences in third-party environments.

None of them, however, allow the brand to identify individual customers and flesh out the customer profile. Nor do many customers appear to welcome these innovations; only about 50% of customers using Apple’s App Store have consented to tracking so far with no real indication this figure will rise.

As a result, many brands have turned to encouraging customers to consent to marketing, and to share the demographic data that’s most useful for personalization. A few companies I engage with will often ask me a single question during most interactions – and over time, they are basically getting me to fill out a personal survey about my preferences. A company innovating in this space is One Creation, whose white label solution allows ecommerce companies to build consent collection steps into their customer journeys.

Remunerating customers directly for their participation can also be a useful part of the mix because many of your customers will happily reveal zero-party data under the right circumstances.

Brands should, however, be cautious as to the nature of the incentives provided. Cash discounts and giveaways come at a high direct cost, and there’s a risk that customers may opt in to claim a reward or a discount, only to opt out again soon after. A far more productive ‘incentive’ is the belief that participation will pay dividends over time, since this encourages long-term engagement – which lays the foundation for customer loyalty.

These dividends could take the form of content that the customer enjoys watching or reading. It could include thoughtful gestures, such as vouchers on their birthday or a ticket to see their favorite band.

Generally, however, the use of loyalty points incentives provides the best balance of low direct costs to the brand and high perceived value to the customer. It’s for this exact reason that customers opt into loyalty programs: they believe that participating will yield rewards with a perceived monetary value – and ideally receive more personalized recognition.

As discussed in a recent article, it costs virtually nothing for the brand to issue points, and they’re useless to the customer unless they redeem on something.

The number that really matters is the redemption cost per point, because this is where the brand incurs real costs, and where the customer realizes the value – hopefully a much higher perceived value than the cost.

Of course, for the brand, that ‘cost’ should be better regarded as an investment which should be tailored to the customer profile. A reward with a direct cost of $2.00 could be a total waste if it doesn’t motivate customer loyalty; a reward with a direct cost of $1,000.00 could be an excellent investment if the customer goes onto spend $20,000.00 in the next few years.

Of course, when the business can tailor incentives based on an informed view of the customer’s likely CLV, the brand can afford to be a lot more generous, because there’s less risk of wastage.

This resolves the flaws with the various alternative ad targeting approaches described above, because the customer willingly provides all this ‘missing’ data, believing that future rewards will be worthwhile.

Access to wider inventory for redemption

Partner-based loyalty programs also improve personalization by giving access to a far wider range of reward inventory, increasing the chances you’ll be able to offer something of personal relevance to individual customers.

Relatively few brands have sufficiently broad inventory to do this on their own. This is largely because most customers’ shopping needs, with most brands, are either occasional or functional.

In grocery, customers may appreciate 50 cents off the same bag of coffee they buy every month, or an offer on a product that is complementary to items they buy frequently (like pasta). The grocer could probably also get manufacturers of complementary goods to fund the incentive (such as shredded cheese or pesto sauce).

Brands also have difficulty making rewards appear worthwhile for customers with a low level of spend.

For somebody who flies frequently for business, earning 3% of the cost of a flight in points may be quite interesting, if they know they’ll take 20 flights in the next 6-12 months and easily be close to a nice reward. These points are therefore personally relevant to that customer.

For most customers, however, even offering 10% of the cost of a flights in points actually poses a risk of a negative impact. That ‘reward’ comes with a realization that they just are not going to travel enough to reach the threshold for a free flight – and that the brand does not understand the customer’s travel patterns. This customer might have high spending power, but just not on travel – and the airline would never know.

And in many other retail and consumer goods categories, if you’re not using loyalty points, the only real alternatives are cash discounts or exceptional service.

For instance, if a customer buys a single $150 dress, the fashion label cannot justify giving a second dress for free due to the relatively high direct cost. A free pair of socks might be appreciated by some customers, but how do you determine which customers to present that offer?. A $10 voucher might bring some of the customers back – once – and if the products are good and the cost seems fair, that might be enough to establish a lifelong habit of buying from a single retailer.

Partner-based loyalty programs help solve these problems in various ways, which we’ve discussed extensively in other articles – but can be summarized as:

- partner inventory – a very wide range of different redemption options at different price points, so that most customers can find something of value in the program

- distressed inventory with low direct costs, i.e., airline seats, restaurant bookings etc., which are predicted to go unsold, allowing the brand to incur low cost in order to create high perceived value to the customer

- ‘earn’ options across the partner ecosystem, so that customers can earn rewards without unusually frequent spending with any one brand – yielding valuable insights for personalization as they spend

- sufficient data to personalize offers – detailed demographic data and personally-identifiable information so that brands can calculate CLV and personalize offers based on ROI.

On that first point: traditionally, loyalty programs relied on a third-party redemption catalog, an ecommerce environment with reward inventory for customers to shop and spend their points on.

Today, third-party redemption catalogs are not necessarily needed. With modern technology, brands can assemble partner inventory and display it in any ecommerce and marketing channels they choose.

More broadly speaking, loyalty programs and loyalty incentives can easily now be integrated into the entirety of the brand’s customer journeys, and power personalization efforts across the martech stack. The only real change required is simply enabling a ‘pay with points’ option at checkout.

Enhancing loyalty personalization across the marketing ecosystem

In recent years, modern technology has made it a lot easier to track and measure individual customers in multichannel contexts, and tailor engagement based on a complete picture of the customer journey.

Much of this progress is not specific to loyalty marketing, but is thanks to the increasing adoption of common technology platforms or data sources by different marketing teams.

Headless commerce platforms and content management systems can enable coherent commerce and campaigning across the website, mobile app, social media and third-party marketplaces such as Amazon. A good example of such a development was Air France-KLM’s adoption in 2023 of Contentstack – a digital experience platform (DXP), which supports multichannel commerce. The implementation of such technology is accelerating.

Some forward-thinking businesses have now also adopted a central customer data platform (CDP) which exchanges data with the various CRMs and marketing platforms in use at the business. Adopting a single enterprise CDP is technically challenging, but where it can be achieved, it can avoid sending conflicting messaging, and help brands accurately calculate CLV based on transactional and non-transactional engagement.

Much more visible progress in this area has taken place in retail stores. In the last 2-3 years, particularly in grocery, mobile apps and modern point-of-sale (POS) devices have greatly simplified the ‘offline to online’ customer journey. This includes the use of mobile apps for in-store browsing and checkout.

This is helpful progress, because historically, identifying customers as they moved between channels was a major challenge. In our recent article on loyalty collection mechanics, we identified 9 different ways to identify a customer at checkout, from simple vouchers and tokens, to QR code scans, to technologies including loyalty card-linking.

Of course, the offline to online interactions (and vice-versa) need to be captured in order to enrich customer profiles.

Today, the combination of modern commerce technology with modern loyalty systems make it easier not only to track individual customers, but also to incentivize customers to consciously identify themselves to the brand. This point is key. I often book a train ticket without bothering to log in to Trainline, or I might buy a bag of chips and Coke at Sainsbury’s without bothering to identify myself as a Nectar member.

Offline: some customers may find waving their phone around in-store to be inconvenient; others may not want to slow down their checkout experience by having to scan at checkout. But the promise of being able to access personalized offers or member-only pricing – now commonplace in grocery stores – has broadly been quite successful in encouraging customers to identify themselves when shopping in-store.

For example, I have found that my primary grocer has got a lot better at giving me coupons for use on my next shopping trip. It used to be about 1 in 10 I would actually use; now it’s 3-4 out of 10. The 3-4 coupons I will use may be worth 3 Euros – which is enough to keep me from buying the basics at a store that is two blocks closer to home.

Online: modern loyalty solution vendors have contributed to this progress by offering API-first technology platforms which can integrate with any customer experience, and incentivize engagement in any channel.

A good example is Antavo, whose cloud-based loyalty platform could integrate with most ecommerce platforms quite easily. This works well for companies launching a new loyalty program from scratch.

Longstanding loyalty program operators, however, such as the best-known travel and grocery programs, cannot in most cases replace their legacy loyalty platform. For these brands, Currency Alliance offers a range of solutions which extend the reach of the brand’s existing loyalty program into new channels and touchpoints. This includes our various white label solutions which allow the brand to add loyalty touchpoints to ecommerce journeys. Our Universal Points Terminal, meanwhile, can be installed on any device that supports a browser in a few minutes, to enable the identification of the customer and the opportunity to earn or burn points effortlessly.

This ultimately supercharges not only the loyalty program, but also the brand’s entire approach to marketing personalization.

A virtuous circle of data and customer engagement

Loyalty programs were always intended to enable more personalized marketing. As a hybrid marketing/financial services discipline, loyalty marketing has evolved with the primary goal of maximizing ROI for the business. Where loyalty marketing is applied, personalization can now unleash opportunities to maximize CLV across all customer segments – and not just the highest spenders.

Today, API-first technology enables the loyalty program to ‘break out’ of this closed loop, extending its potential reach to all of the brand’s touchpoints and channels.

At the core of every loyalty platform are two pieces of technology used for scoring different customer actions and to inform further promotions and incentives. These are the loyalty points bank, and the loyalty rules engine.

We’ve written full-length articles on the points bank and the rules engine, but to summarize:

- the rules engine is a tool for varying incentives based on the context of the transaction, i.e., issuing more points if it’s a customer with high potential CLV, or lowering the price in points if the inventory is distressed

- the points bank’s primary function is to maintain a record of points transactions. The by-product of this is that the brand has a highly useful scoring system for different customer actions, since there will be a record of points accrued or spent for transactional and non-transactional engagements.

In theory, modern, SaaS versions of the points bank and rules engine could be used to score and measure the effectiveness of personalization and incentives across the business, rather than only on traditional loyalty touchpoints.

What can certainly happen, however, is for data from both the loyalty program and the brand’s other martech systems to be exposed in the brand’s data and analytics platforms. That will enable a coherent view of all marketing activity and inform insights such as:

- whether the business should allocate more or less focus to loyalty, CRM, paid media etc.

- whether to invest more or less in certain types of incentives

- how best to motivate different customers based on CLV

…etc.

This is hugely valuable, because in the last 3-5 years, many business professionals have finally begun to appreciate the unique capabilities of the loyalty program within the wider context of the business.

Today, awareness is gradually spreading that the loyalty program is a far lower-cost channel for customer acquisition and retention than paid media, affiliate marketing, cash incentives, etc. It’s also increasingly considered advantageous over marketing channels which rely on guessing the customer’s preferences or which set a lower bar for customer consent.

With technological and cultural blockers to integration now resolved, brands should focus on accelerating the virtuous circle of data and engagement across different marketing systems and channels.

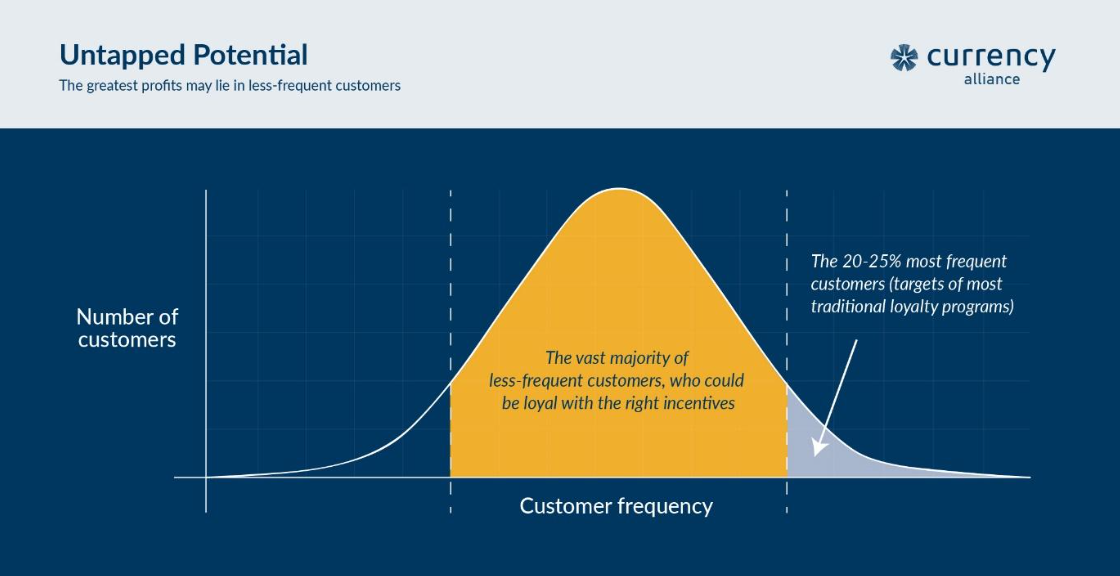

Until recently, having 25% of customers active in the loyalty program was considered a good level of engagement (except grocery, which is much higher because of total spend and higher frequency). Today, many retailers with modern tools are seeing rates of 40% to 60% (depending on category), and brands are now working hard to increase engagement rates because a pot of gold lies in those customers they previously failed to reach.

As this chart shows, the long-time focus on a brand’s highest spending customers left a massive opportunity in the mid-to-long tail.

While the highest-spending customers have been well-served by loyalty programs, a brands’ only real answer for mid-tail customers was to irritate them with programmatic media and hope that a low percentage of them bought something.

Irritating customers is no longer necessary. As we have explained here, modern technology has allowed loyalty marketing to be introduced to practically all of a brand’s marketing channels and applied to all customer segments. This means more customers can be positively identified, with consent, and promotions can be targeted in a way that truly feels personal, based on more complete customer profiles.

The example of brands such as Wayfair demonstrates that very significant progress has been made in personalization capabilities across all areas of the martech stack. Overlooking the potential of the loyalty program to enhance these efforts would be a massive oversight.